Property consultancy Colliers said it did not record the completion of any condominium project in Metro Manila in the first quarter of 2025, and only 87 units were sold in the pre-selling market during the period, a reflection that the condominium market in the metro remains challenging.

In its first-quarter residential report released on May 14, Colliers said developers have been launching fewer pre-selling units as they remain aggressive in introducing new residential projects in competitive localities outside of the capital region.

“The residential market outside of Metro Manila records strong take-up, especially in key localities such as Cebu, Bacolod, Iloilo, Davao, Pampanga, Bulacan, Cavite, and Laguna,” the report said but did not elaborate.

Tempered supply

Colliers said it anticipates the completion of 8,600 units by the end of the year, an increase of 10 percent year-on-year of about 7,740 units.

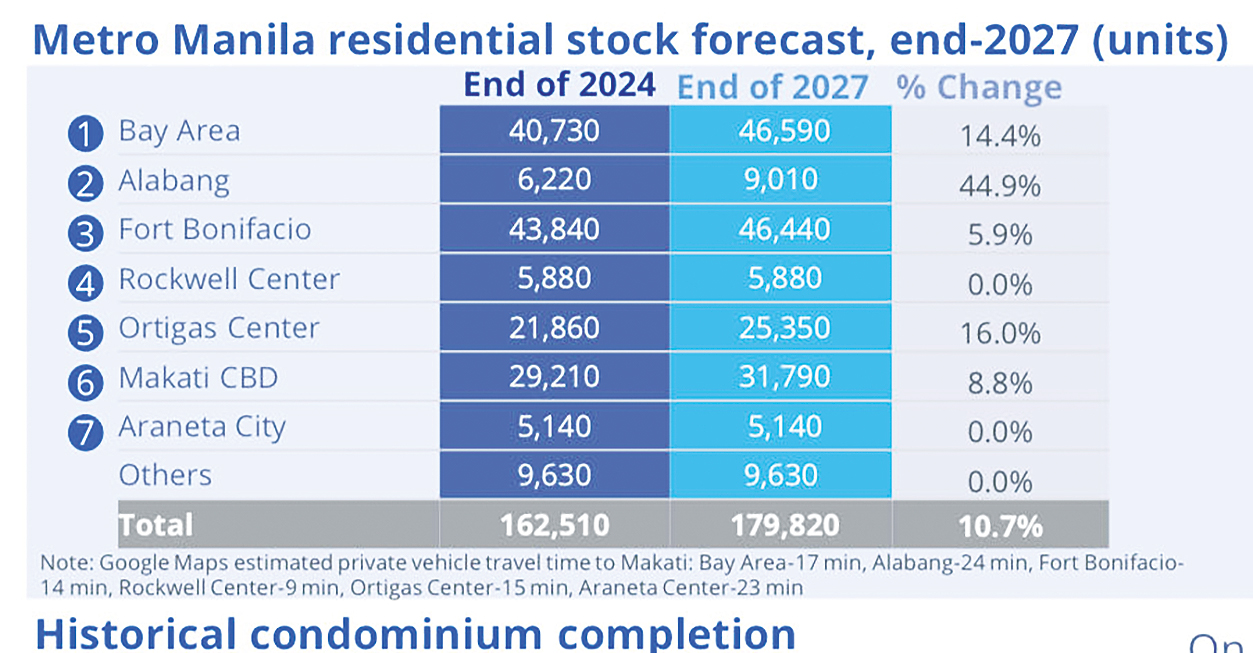

But over the next two to three years, Colliers sees tempered new supply. From 2025 to 2027, we expect the annual average completion of 5,800 units, down from the 13,000 average from 2017 to 2019, which was the peak of demand from Philippine offshore gaming operations (POGO).

Based on its Colliers’ assessment, the Bay Area will be the largest residential hub by end-2025, overtaking Fort Bonifacio with 45,800 units or 27 percent of total supply in Metro Manila.

Colliers forecasts the delivery of only 2,500 units in 2027, an 84 percent drop from the 16,000 units completed in 2017.

“Overall, we see tempered launches in the pre-selling market persisting in the near term,” it added.

But as it is, Colliers said it recorded the launch of 5,300 units in Metro Manila’s pre-selling market during the first quarter, up 83 percent year-on-year and the highest-recorded number of quarterly launches since the third quarter of 2023.

The report said among the notable newly launched projects during the first quarter are Avida Land’s Avida Towers Makati, Southpoint Tower 3 in Makati, 8990’s Urban Deca Tondo – Bldg. 7 in Tondo, and Shang Robinsons Properties’ Haraya Residences –North Residences in Bridgetowne, Pasig.

Joey Bondoc, Colliers head of research, said the company is no longer surprised with the stifled launches as this has been the trend since 2020 – at the height of the pandemic.

“The dampened appetite for pre-selling units was exacerbated by the POGO exodus. Developers remain focused on offering attractive and innovative ready-for-occupancy (RFO) promos, including substantially lengthened lease terms for completed condominium units,” Bondoc added.

Back-outs Colliers said it recorded the net takeup of 87 pre-selling units in the first quarter.

“While we have seen the take-up of 4,800 units during the period, back-outs, particularly for older projects, reached 4,700 units,” Colliers said.

According to the report, the lower and upper mid-income segments or those priced between P3.2 million and P12 million accounted for 65 percent of total back-outs during the period.

However, Colliers is optimistic that further interest rate cuts and sustained remittances from Filipinos working abroad should partly lift the demand for mid-income projects.

The central bank projects OFW remittances to grow by 3 percent in 2025.

Rising vacancy

Colliers recorded a marginally rising vacancy in the Metro Manila secondary market that by the end of 2025, expect vacancy is expected to reach 26 percent, an all-time high given the still-significant delivery of new projects and the impact of the POGO ban lingering across Metro Manila.

“We expect the elevated vacancy to likely result in rental and price corrections of between 1 percent and 1.5 percent in 2025,” Colliers said.

It added investors and end-users should continue scouting for attractive promos for both pre-selling and secondary units at this point.