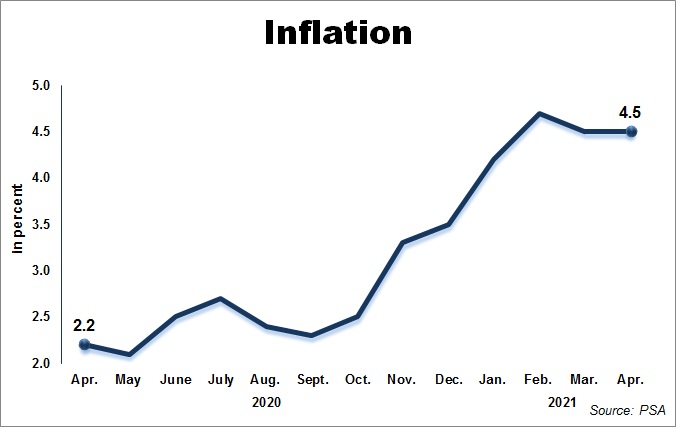

Inflation remained elevated last month, hitting 4.5 percent, pushed by increases in the indices of transport, health, housing and utilities.

April’s figure is the same as March’s 4.5 percent and twice as fast as the 2.2 percent posted in April last year.

The Philippine Statistics Authority (PSA) said this brings the average inflation at the national level from January to April 2021 to 4.5 percent, above the full-year target range of between 2 and 4 percent set by the government.

The Philippine Statistics Authority (PSA) said this brings the average inflation at the national level from January to April 2021 to 4.5 percent, above the full-year target range of between 2 and 4 percent set by the government.

“Varied annual growth rates in the indices of the commodity groups were observed in April 2021,” PSA maintained.

The government agency, however, stressed that inflation slowed down in the indices of food and non-alcoholic beverages at 4.8 percent, and alcoholic beverages and tobacco at 12 percent.

PSA added, excluding selected food and energy items, core inflation decelerated to 3.3 percent in April 2021, from 3.5 percent in the previous month.

Benjamin Diokno, Bangko Sentral ng Pilipinas (BSP) governor, said the latest outturn “is consistent with expectations that inflation would remain elevated this year” but is seen to settle close to the midpoint of the target range next year.

He said this is due to supply side pressures.

“The balance of risks to the inflation outlook remains balanced around the baseline path in 2021, while toward the downside in 2022. The ongoing pandemic continues to pose downside risks to the inflation outlook and growth prospects,” Diokno said.

“In addition, inflation expectations remain well anchored to the inflation target over the policy horizon. However, improvements in external demand as well as continued rollout of the government’s COVID-19 vaccination program and other stimulus measures will bolster economic recovery,” he added.

Diokno said the timely approval of the temporary cut in pork import tariffs “is seen to help address supply constraints and ease price pressures going forward.”

PSA said inflation for food index at the country level decelerated to 5 percent during the month, from 6.2 percent in March 2021.

Annual rates also went down during the month in the indices of rice and vegetables at -0.3 percent and -2.6 percent, respectively.

“The BSP remains watchful over the evolving economic conditions and challenges brought about by the pandemic, to ensure that the monetary policy stance remains consistent with its price and financial stability objectives,” Diokno said.

Nicholas Mapa, ING Bank Philippines senior economist, said should price pressures continue to dissipate, “we can expect inflation to decelerate as early as next month with February’s 4.7 percent possibly the peak for the year.”

“Upside pressure on inflation remained confined to specific supply side issues (African Swine Fever for pork and global crude oil prices) as well as pandemic-related health protocols (tricycle fares, restaurants and other services) while demand side pressures stayed muted with inflation for recreation and culture stuck in deflation for a 9th straight month,” Mapa noted.

Mapa said the BSP has “largely looked past the 2021 inflation breach, opting to accommodate the 4 months that inflation has moved past the 2-4 percent inflation target.”

“BSP Governor Diokno has reiterated that the current inflation spike is transitory and upward pressure on inflation appears to be dissipating as supply side bottlenecks are addressed,” Mapa said.

Meanwhile, Mapa said economic activity remains subdued with the capital region in partial lockdown and the economy in recession.

“We expect BSP to remain on hold for the whole of 2021 to provide support to the economy and we believe inflation will begin to decelerate further in May as supply side issues are addressed by supply side remedies,” Mapa said.

Even if inflation has shifted higher in the last five months, the policymaking Monetary Board late March decided to maintain the key rates of the BSP.

The interest rate on the BSP’s overnight reverse repurchase facility stays at 2.0 percent. The interest rates on the overnight deposit and lending facilities were likewise kept at 1.5 percent and 2.5 percent, respectively