View from Leechiu Property Consultants

Leechiu Property Consultants (LPC) said the residential market is experiencing tempered growth as demand remains steady.

Roy Golez, LPC head of research, said takeup is steadily picking up with 6,643 units sold in the second quarter of the year, up 2 percent from the prior quarter.

The number of new launches of condominium units was recorded at 1,761 units, up 31 percent.

Golez said condominium developers have opted to sweeten their deals — longer payment terms, rent-to-own schemes and big discounts on a limited number of units — which raised interest for condominium ownerships further.

“We’ve heard some developers have successful in their rent-to-own efforts; some being sold out in about a week’s time. Other developers offer 150 units and in two weeks’ time, sell about 100 units,” he said.

Rental yields modest

Rental yields range between 2 and 8 percent, “reflecting a relatively modest returns for property investors,” Golez said.

While financing conditions are improving for buyers—driven by declining interest rates, attractive developer payment terms, discounts, and value-added features—declining rental yields may be discouraging investors seeking passive or rental income–based returns.

Golez said for prime village buyers, options south of Metro Manila are becoming increasingly attractive, with prices offered at a significant discount compared to traditional choices in core central areas.

Resilient borrowers

According to LPC, non-performing residential real estate loans held steady at 6.3 percent from the fourth quarter of 2024 to the first quarter of 2025, indicating resilient borrower capacity. Borrower positions may be further strengthened by two additional key policy rate cuts expected within the year.

Tempered growth

LPC said in spite of the competitive terms and value-added features offered by developers, demand remained tempered by a softening appetite from passive investors and speculative buyers.

Rental yields continue to be affected by POGO exit–driven corrections and the likely high availability of units for lease.

Villages south of Metro Manila post healthy takeup with improved accessibility from existing infrastructure projects, affordability, and well-planned townships.

LPC said the shift of buyer preferences to outside Metro Manila has been made possible by the participation of top developers introducing a wide range of high-quality, master-planned developments.

Demand surge

It cited the demand surge in the mid-market in Cebu City.

LPC said the majority of the remaining residential condominium supply in Cebu Province is located in Metro Cebu. Demand declined by 15 percent, from 2,763 units in the second half of 2024 to the first half 2025, while supply increased by 14 percent to 3,195 units over the same period.

Notably, the middle-income segments—particularly the two lowest sub-segments—performed strongly in the first half of the year, followed by the “Demand drivers remain strong, developers are offering more lenient payment terms, and financing conditions are becoming more favorable. However, actual sales continue to lag as buyers are held back by declining rental yields and the perception of overpricing. We believe the developer-buyer relationship has to evolve and deepen into a mutually beneficial arrangement and not just rely solely on price-based incentives.

They can focus on income-enhancing and risk-reducing measures—such as rent support programs, enhanced and sustained after-sales services. These can help give buyers the confidence to invest despite the current yield-challenged market,” Golez said.

Lobien Realty Group’s take

‘To address the observed oversupply of condominium units, developers are recalibrating their priorities and realistically meeting market demand by focusing on selling existing condo inventory.’

Property consultancy companies Leechiu Properties Consultants (LPC) and Lobien Realty Group (LRG) weighed in on the performance of the Philippine residential market in the second quarter of 2025,

In a report, LPC said the residential market is experiencing tempered growth despite steady demand and a slight increase in unit take-up.

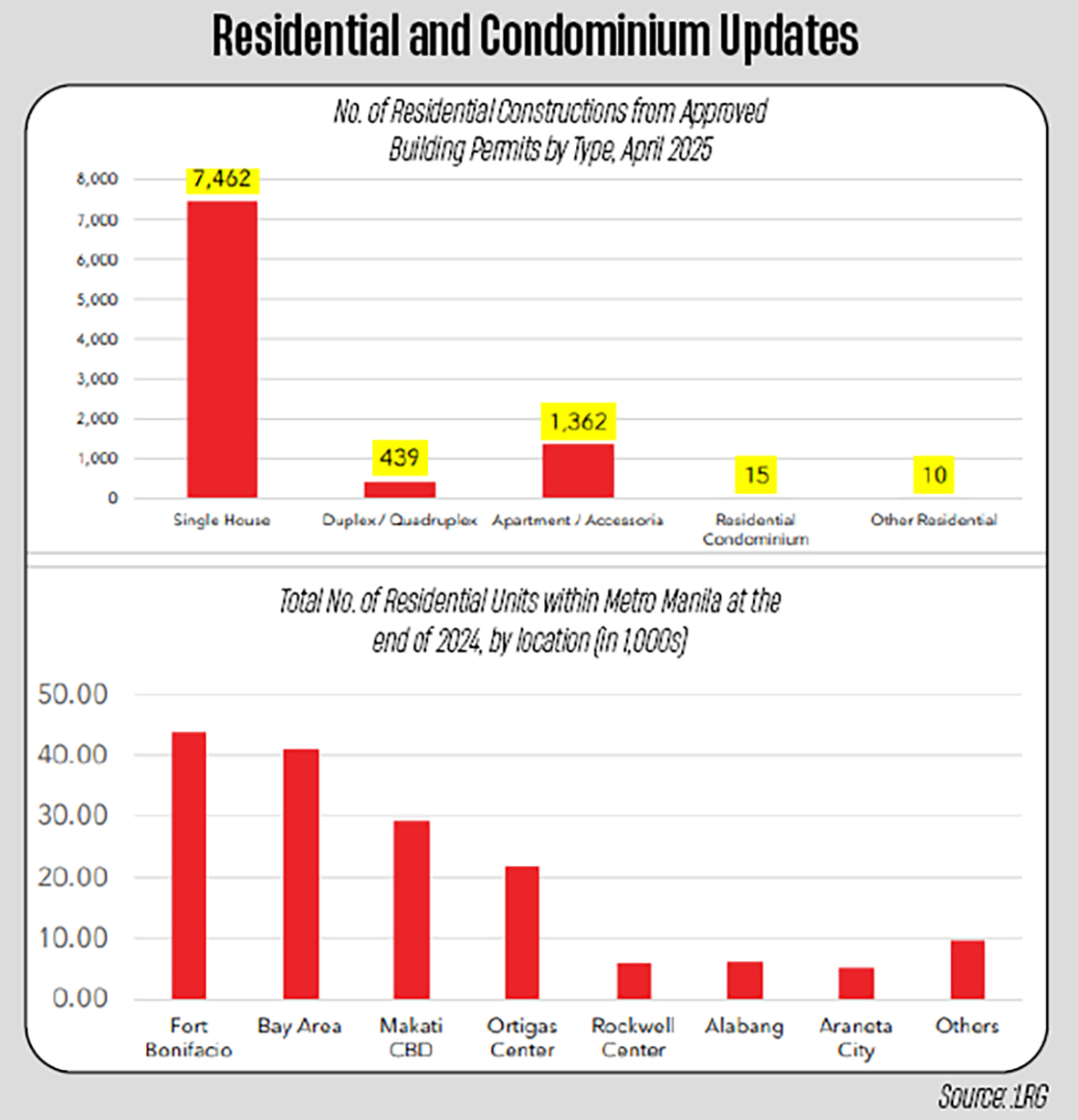

In a separate report, LRG said the slow but steady uptick in residential real estate demand is held back by still relatively high interest rates and an oversupply of condominium units.

Lobien Realty Group Inc. (LRG) said there has been an uptick in the demand for residential market, albeit slow.

LRG said despite the moderated interest rates — around 6.5 to 7.5 percent — these remain high compared to pre-pandemic levels, suppressing demand and slowing loans.

“With that kind of interest rate, even the developers will not borrow money to build more projects. So, they’re also waiting. And it’s good that the inflation rate is now within the bandwidth of the central bank. And interest rates are slowly going down. Many Filipinos, of course, would still want interest rates to really go further down,” LRG founder Sheila Lobien said.

Lobien cited a report of the Bangko Sentral ng Pilipinas (BSP) which said loans contracted among all types of housing units in the fourth quarter of 2024, except for condominiums that grew by 7.5 percent in the same period in 2023.

The BSP data added that total real estate prices for various types of new housing units in the Philippines increased 7.6 percent year-on-year in the first quarter of 2025.

The BSP report said the National Capital Region (NCR) experienced housing prices increased 13.9 percent while residential property prices in the provincial areas contracted by 3 percent. Per housing type, condominium prices rose 10.6 percent.

In terms of residential real estate loans granted, the NCR accounted for 27.4 percent, followed by the Calabarzon region with 29.9 percent.

Central Luzon had the lowest concentration with 13.8 percent. Six out of every 10 residential real estate loans were for houses, while four out of 10 were for condominium units.

According to Lobien, the current over-supply in the condominium market points to a “buyer’s market” in the residential sector. Condominium units and dormitories within the central business districts have a strong market for employees who need to address transport issues.

LRG said to address the observed oversupply of condominium units, developers are recalibrating their priorities and realistically meeting market demand by focusing on selling existing condo inventory rather than speeding up development of new projects.

Lobien said the prevailing offers of better prices, higher discount rates, and longer payment options for the downpayments from developers are good inputs to residential buyers and investors.

OFW market

For LRG, many Filipinos, especially the overseas Filipino workers, still buy properties using loans from the bank.

“The OFW market has always been there,” Lobien said.

The LRG report noted an increase in demand for single detached homes and lots outside of Metro Manila and mid-to-higher end/low density condominium developments in the central business districts, closer to places of work.

Lobien said this will be good opportunities for the developers.

“All the more now, the developers, big players, are focusing on the domestic market, local buyers, the OFWs, and the employees of the BPOs, the outsourcing industry. They are the ones who can really purchase the excess or the oversupply that we have now,” Lobien said.

Boom in house & lot

But she noted the dream of many Filipinos is to have their own house and lot, not really a condominium.

“House and lot properties in the provincial areas are booming, they’re growing, and developers are leading the way,” Lobien said.

She added that the Build, Build, Build infrastructure projects are fueling the growth of many residential projects outside Metro Manila.

Location-wise, these hotspots include Clark, Cavite, and Laguna as well as Cebu and Iloilo in the Visayas.