As the economy continues to recover and more businesses resume operations and expand, Colliers Philippines believes the property market is well-positioned to ride this growth trajectory.

In a report released September 2, Colliers said the office sector is seeing an increase in transactions within and outside Metro Manila.

Metro Manila alone registered two consecutive quarters of positive net take-up.

At the end of the second quarter, Colliers saw sustained leasing activities in the Metro Manila office market.

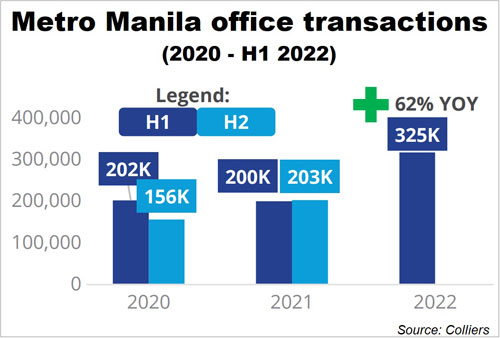

In its report, Colliers said it recorded about 325,100 square meters (sq.m.) of office transactions in the capital region in the first half.

That is 62 percent higher compared to the 200,700 sq.m. a year ago. Traditional and outsourcing firms supported office space take-up during the period, the report said.

Colliers also saw the completion of 146,700 sq.m. of new office space in the second quarter.

Colliers forecasts the annual completion of about 543,300 sq.m. from 2023 to 2026.

This means the office property sector will revert to pre-Philippine offshore gaming operation or POGO levels where yearly completion was between 450,000 and 550,000 sq.m. from 2014 to 2016.

But this is far from the peak period of from 2017 to 2019 when POGO annual take-up was 983,900 sq.m.

Colliers noted vacancy as of the second quarter slightly rose to 17.7 percent from 17.3 percent the previous quarter.

“We recorded no substantial increase in vacancy as new supply was halved to 146,700 sq.m. in Q2 from 306,100 sq.m. in Q1. This was also supported by higher office deals in Q2 2022 compared to Q1 2022,” Colliers said.

Colliers projects office vacancy to reach 18.2 percent by the end of 2022 from 15.7 percent in 2021.

It sees net take up to reach 350,000 sq.m. by the end of the year from 273,300 sq.m. in 2021.

Average rents in Metro Manila meanwhile dropped 2.6 percent quarter-on-quarter in Q2 2022, Colliers said.

This is slower than the 3.1 percent decline in Q1 2022.

“ In our view, rents are likely to drop by about 7 percent in 2022 before we see a recovery starting 2023,” Colliers said.