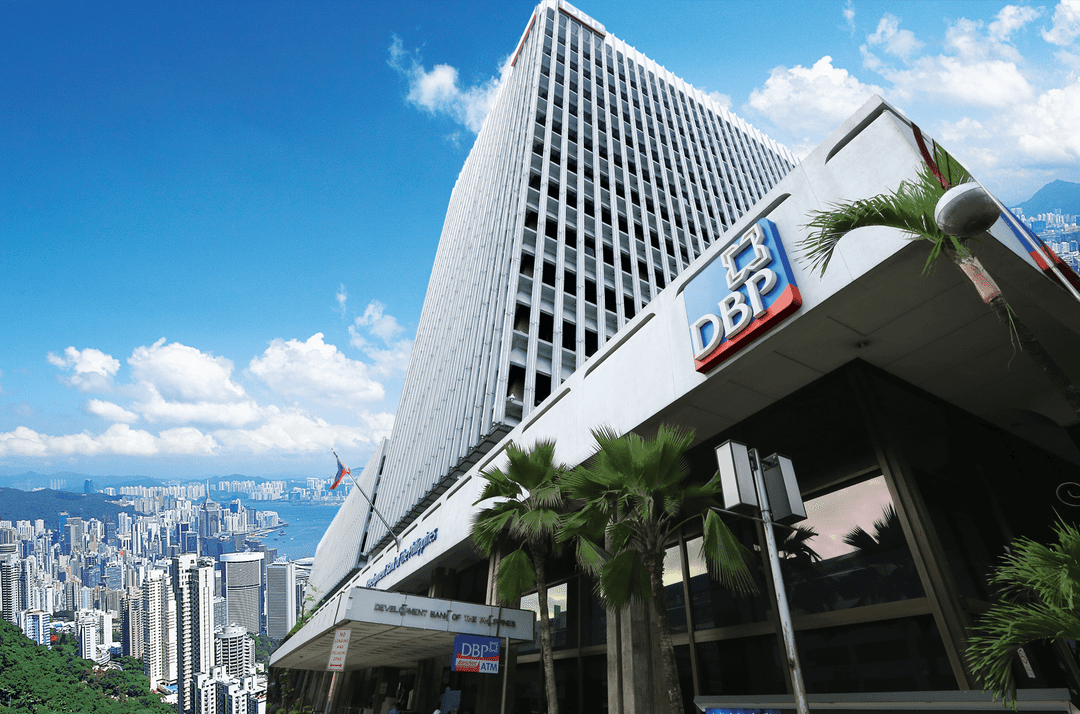

State-owned Development Bank of the Philippines (DBP) is open to establishing an Islamic banking unit (IBU) once it has completed the sale of Al Amanah Islamic Investment Bank to the Bangsamoro government.

DBP President and CEO Michael de Jesus said they are considering applying for an IBU license to expand its network of inclusive finance.

“DBP continues to explore avenues to support inclusive finance, including Islamic banking,” he said in an email to Malaya Business Insight.

De Jesus said there are no concrete plans as yet when they will apply for an IBU license with the Bangko Sentral ng Pilipinas (BSP), but the bank has started its review of venturing into Islamic finance.

The bank still has controlling shares in Al Amanah Bank which they have been negotiating to sell to the Bangsamoro Autonomous Region in Muslim Mindanao (BARMM).

At the moment, BARMM is still in the process of acquiring BSP approval for the buy-out. It was only on September 3, 2024 when the proposed purchase of DBP shares in Al Amanah Bank was approved by the Intergovernmental Fiscal Policy Board.

De Jesus also declined to reveal the details of valuation or expected proceeds from the transaction because the amount “have not been publicly disclosed,” he said.

But, he said BARMM “is currently in the process of complying with certain requirements and has expressed continued commitment to the plan.”

DBP may start application procedures for an IBU license once it has completed its review of BSP’s regulatory requirements.

Under BSP regulations, an IBU is a division, department, office, or branch of a conventional or traditional bank that operates in accordance with Shari’ah principles.

The BSP has already approved two IBU licenses, one for Malaysian-owned Maybank Philippines and for microfinance rural bank, CARD Bank Inc.

BARMM in May this year has already issued the guidelines on the submission of requests for Shari’ah opinions of the Shari’ah Supervisory Board (SSB).

The SSB issues opinions on Islamic banking transactions and products when requested by the BSP or other financial institutions in the BARMM.

The SSB was established through a joint circular of the BSP, Department of Finance and the National Commission on Muslim Filipinos on April 26, 2022. The joint circular complements provisions under the Islamic Banking Law or Republic Act No. 11439, in promoting Islamic banking ecosystem in the Philippines.

In Islamic banking and finance, all financial services should be consistent with the Shari’ah principles.

Islamic banks offer products with no interest or “riba” since this is prohibited in Shari’ah. “Rather, Islamic banks offer alternative arrangements to generate income,” the BSP said.

In applying for an IBU license, a conventional bank must be compliant with the BSP’s prudential criteria and has a system for segregating the Islamic banking transactions of the IBU from its conventional banking business, as well as establishing an appropriate Shari’ah Governance Framework (SGF).

The capital requirement is one of the reasons why there are few IBU applicants. A hefty capital is also needed to establish an SGF. The SGF ensures that the Islamic bank or IBU adheres to Shari’ah principles and has a Shari’ah Advisory Council.