A Special Report by Malaya Business Insight

Turning up the heat

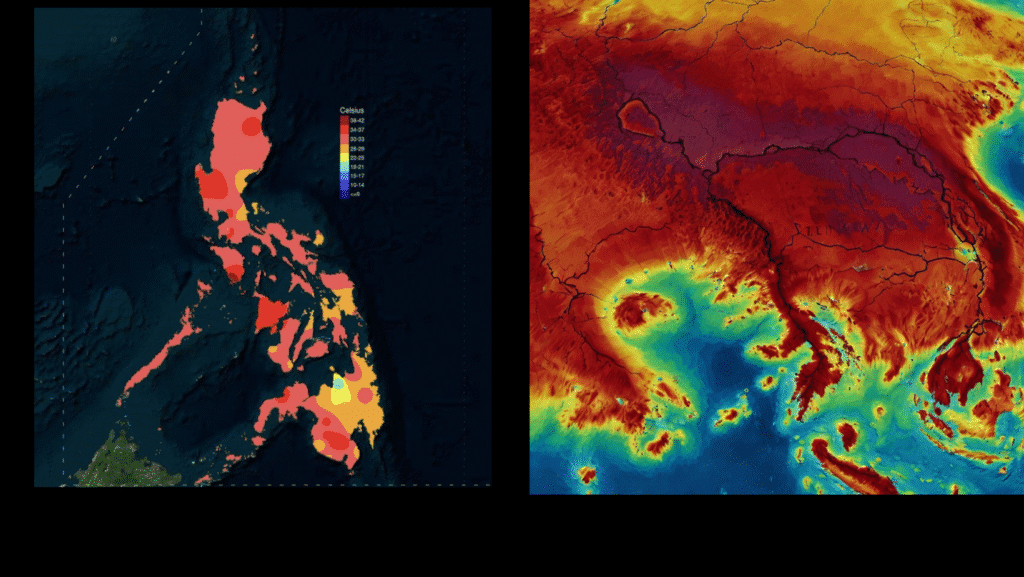

Following a transformative first quarter, the Philippine energy sector entered Q2 2025 facing one of its most difficult tests yet—managing peak electricity demand during the height of the dry season. As the country endured record-breaking temperatures, electricity consumption surged across Luzon, Visayas, and Mindanao, straining the power system and exposing gaps in infrastructure, integration, and regulatory alignment.

While new renewable capacity like the 218.75 MW Talim Wind Power Plant came online, peak summer demand outpaced supply additions,

forcing grid operators to restrict power exports between regions and implement demand management measures.

The quarter offered a telling snapshot of a sector in transition.

Major renewable energy projects came online, such as the 218.75 MW Talim Wind Power Plant, while smart grid technologies and battery storage systems started to gain traction in both policy and practice. Yet, these gains were counterbalanced by recurring yellow alerts and thin reserve margins, revealing that the shift to cleaner power requires far more than just new capacity—it demands a systemic rethink of how electricity is generated, stored, and distributed.

The season of high demand and new capacity

Q2 2025 was marked by a mix of promising developments and persistent bottlenecks. On the one hand, the country’s energy mix continued to diversify. Wind power received a substantial boost with the commissioning of the Talim Wind Power Plant in June. This marked a renewed show of confidence from the private sector in wind technology’s potential to complement solar’s daily cycle.

Additional capacity came from smaller renewable projects, including the 4.8 MW Dupinga Hydroelectric Plant and over 15 MW of new solar energy from the San Jose projects. These installations highlighted the growing role of distributed generation in the Philippine energy landscape.

Natural gas also played a vital role in ensuring system reliability. The 440 MW Batangas Combined Cycle Power Plant, which began operations in March, provided critical baseload capacity, especially as older fossil fuel plants face eventual phase-outs.

However, delays in permitting and ongoing supply chain issues meant that the Department of Energy’s 7,000 MW capacity addition target for the year is now at risk. Many projects remain stuck between commitment and commissioning, widening the gap between energy forecasts and actual system readiness.

The grid under pressure

The second quarter exposed the vulnerabilities of an evolving grid. Actual power consumption exceeded expectations, with Luzon and Visayas experiencing particularly tight conditions. Luzon bore the brunt of demand spikes, driven by high air-conditioning usage and compounded by unplanned outages at baseload plants. Yellow alerts were issued on multiple occasions, warning of dwindling reserves.

In the Visayas, the situation was no less tense. The region relied heavily on power imports from Luzon and Mindanao via the 250 MW high-voltage DC interconnection. But by early June, export restrictions were imposed as Luzon began prioritizing its own needs. The episode underscored the risks of overdependence on inter-island transfers without adequate backup.

In contrast, Mindanao proved relatively stable, maintaining reserves and continuing to export electricity. Its more diversified generation base and less intense demand provided a glimpse of what well-balanced regional systems could look like.

Energy storage as core infrastructure

One of the quarter’s most significant policy shifts involved energy storage.

For the first time, battery storage systems were formally included in the government’s energy procurement framework. In March, the Department of Energy launched the fourth round of the Green Energy Auction (GEA-4), which included paired procurement for solar and storage—signaling the recognition that renewables alone cannot guarantee reliability.

The DOE followed this up with updated policy guidelines in April, covering multiple storage technologies, including battery systems, flywheels, compressed air, and pumped hydro.

Encouragingly, the government also adopted a technology-neutral stance, allowing for the integration of emerging solutions like hydrogen and sodium-based storage.

Foreign investors have responded positively. The $13.7 billion in foreign capital mobilized under the 100% ownership policy includes substantial investments in energy storage, confirming that storage is now seen as essential infrastructure, not just a supplementary feature.

Smart grids: from idea to necessity

As renewable capacity expands, managing energy flows becomes increasingly complex. The second quarter demonstrated the limits of traditional grid operations and highlighted the importance of smart grid technologies.

These systems enabled real-time monitoring, fault detection, and bidirectional energy flow management—all of which proved crucial as distributed sources like rooftop solar fed power back into the system during peak midday hours. Automated grid responses prevented wider outages during unexpected supply shocks, shortening downtimes and optimizing energy use.

Smart grid platforms also coordinated storage discharge cycles, smoothing out the fluctuations typical of wind and solar generation. Without these tools, the quarter’s intermittent renewable supply could have triggered even more serious disruptions.

Regulatory flexibility and real time response

In response to operational pressures, both the DOE and the Energy Regulatory Commission began adjusting key policies. One major area of focus was the regulatory classification of storage systems. Under current rules, storage is categorized as generation, which limits ownership due to market share caps imposed on generating companies.

There is growing consensus that this classification needs to evolve. Storage serves multiple functions—providing backup, enhancing grid stability, and firming up renewable output. Recognizing these roles will allow greater investment and enable a more flexible and responsive power system.

More broadly, regulators showed a welcome willingness to adapt rules based on emerging realities. By embracing a technology-agnostic approach and loosening restrictions on foreign ownership, the Philippines is positioning itself as a more attractive and capable energy investment destination.

Changing investment priorities

The lessons of Q2 are already influencing investment decisions. Wind energy is regaining attention thanks to the successful launch of the Talim project. Storage projects are rising in priority as investors respond to clear policy signals and the increasing market need for grid-balancing tools.

There’s also growing interest in distributed generation. Smaller-scale projects located closer to demand centers offer greater reliability and avoid the transmission losses and congestion associated with large-scale plants.

Natural gas remains part of the short-to-medium-term solution, providing flexible backup to renewables. And investors are shifting focus from sheer capacity numbers to grid integration readiness. Projects that include storage or advanced grid management tools are increasingly favored for their resilience and operational value.

Summer class: the key lessons Learned

Q2 made it clear that the energy transition is more than just building more renewables. It also involves executing those builds well, ensuring grid integration, and planning for system-wide coordination. The timing gap between project approval and commissioning, for instance, still remains a major bottleneck.

Equally important is the need for demand-side strategies. Seasonal surges in consumption underscore the value of programs that promote efficiency and behavioral shifts—especially during periods of extreme weather.

Conventional plant reliability still matters, especially as renewables become the dominant source of new generation. Transitioning systems must maintain legacy infrastructure while recalibrating operations to work in tandem with intermittent sources.

The case for integrated resilience

What Q2 2025 exposed is that true energy resilience will come from integration—not just expansion. The success of renewable projects must be accompanied by smart planning, responsive grid management, and robust regulatory support.

Battery storage’s mainstream adoption through GEA-4 marks a pivotal shift in this direction. The increasing use of smart grid technologies shows how operational efficiency can offset volatility. And the evolving regulatory landscape signals institutional flexibility—a key ingredient in any successful transition.

By aligning generation, transmission, storage, and consumption strategies, the Philippines can build an energy system that is not just cleaner—but smarter, faster, and more resilient.

Looking Forward: Transition Resilience Under Test

Q2 2025 tested the Philippine energy sector’s resilience during a critical transition period, revealing both strengths and vulnerabilities in the evolving power system. While supply constraints and grid stress created operational challenges, the successful integration of new renewable capacity demonstrated that the transformation continues progressing.

The quarter’s experience validated the importance of energy storage integration, smart grid technology deployment, and regulatory flexibility in managing complex energy transitions. The formal inclusion of storage in government auctions and policy frameworks represents a maturation of market understanding about renewable integration requirements.

Most importantly, Q2 showed that energy transitions require more than adding clean capacity—they demand fundamental changes in grid management, market design, and operational practices. The Philippines’ ability to adapt its regulatory framework and investment priorities based on operational experience suggests the institutional capacity exists for successful transformation.

The challenges encountered in Q2 provide valuable learning opportunities that will strengthen system resilience as renewable penetration increases. Energy transitions are iterative processes where operational experience informs policy evolution and investment decisions.

The Philippine energy sector emerges from Q2 2025 with greater practical knowledge about renewable integration challenges and proven solutions for addressing them. This experience positions the country to accelerate its clean energy transition while maintaining the system reliability essential for economic growth.

This analysis is based on Q2 2025 operational data, regulatory developments, and market observations. The Philippine energy sector continues evolving rapidly as stakeholders adapt to transition period challenges and opportunities.