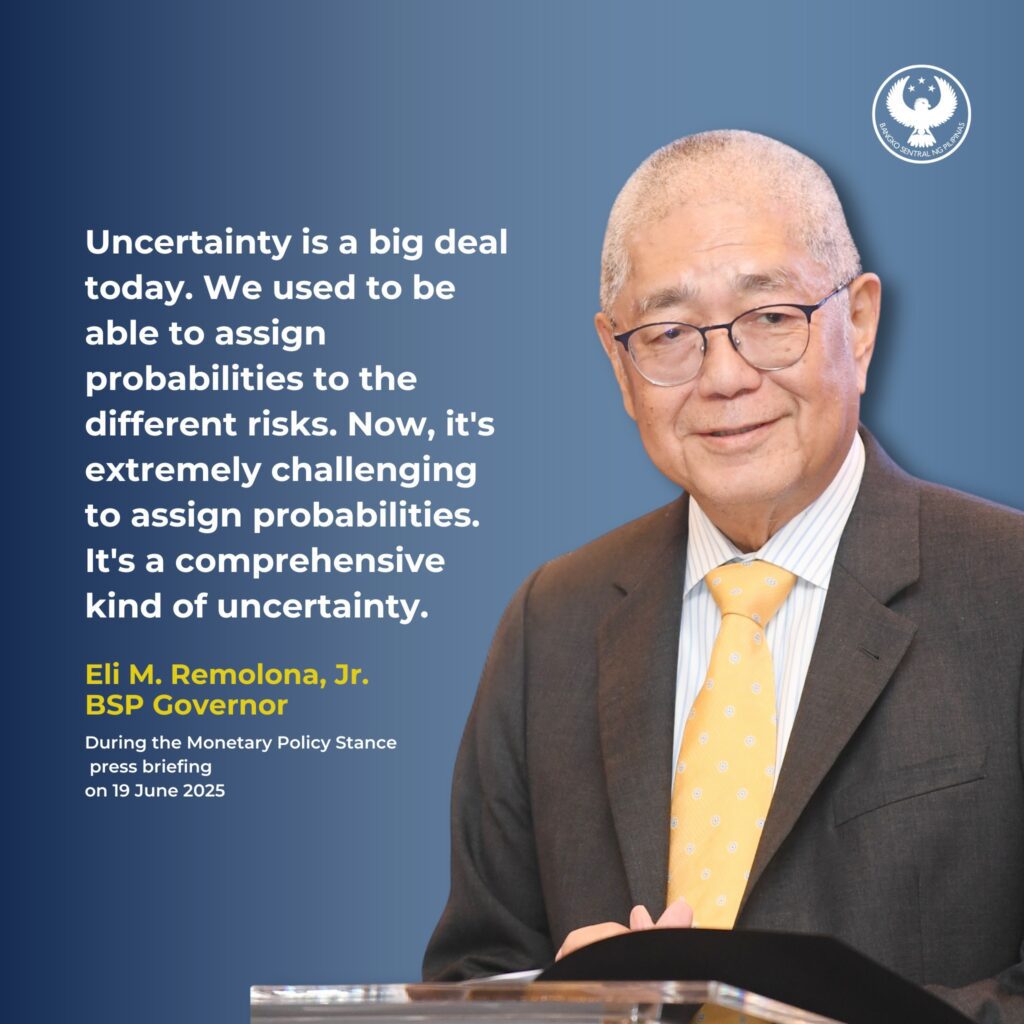

As the Bangko Sentral ng Pilipinas (BSP) marks its 32nd anniversary, Governor Eli M. Remolona, Jr. delivered a powerful and reflective speech, underscoring the institution’s role as a guardian of monetary and financial stability, and charting its course for the future in an evolving global landscape.

A journey of stability and progress

Governor Remolona begins with a nod to BSP’s steadfast commitment to price stability—a cornerstone of economic growth and public trust. Over the decades, the BSP has navigated turbulent economic waters, from the Asian financial crisis to the recent global pandemic, successfully steering the country through uncertainty by employing sound monetary policies and regulatory frameworks.

“The BSP’s dedication to maintaining a stable currency is a bedrock upon which national progress is built,” he emphasized, reminding listeners that stable prices translate into enhanced business confidence and improved livelihoods across the nation.

Innovation and adaptation amidst change

Aware of rapid technological advances reshaping the financial sector, Governor Remolona outlined the BSP’s proactive approach to innovation. From promoting financial inclusion via digital platforms to adopting regulatory measures for emerging fintech and digital currencies, the BSP positions itself not just as a regulator but as a catalyst for modernization.

He highlighted the launch and expansion of digital banking services and the strengthening of cybersecurity protocols, ensuring that financial innovation is balanced with consumer protection and system integrity.

Resilience through risk management

The Governor spoke candidly about the challenges posed by external shocks—climate change, geopolitical tensions, and global market volatility—that test the resilience of the Philippine economy. BSP’s robust risk management strategies, including enhanced supervision of banks and financial institutions, form a crucial part of safeguarding against systemic risks.

He affirmed that the BSP continues to elevate its crisis preparedness and response capabilities, fortifying the financial sector’s backbone to withstand future disruptions.

Inclusive growth and sustainable development

Governor Remolona cast a vision that extends beyond monetary policy, emphasizing the BSP’s role in promoting inclusive growth and sustainable economic development. He detailed initiatives aimed at broadening access to financial services for marginalized sectors, supporting micro, small, and medium enterprises, and integrating environmental considerations into banking regulations.

This, he argued, ensures that economic benefits reach all Filipinos while preserving resources for future generations.

A call to trust and partnership

Closing his speech, Governor Remolona called on all stakeholders—government, businesses, and the Filipino people—to continue their partnership with the BSP. Trust and collaboration, he said, remain vital in achieving a sound, efficient, and inclusive financial system.

“The BSP stands as a dedicated institution, committed to nurturing the resilience and growth of the Philippine economy,” he concluded. “Together, we can forge a prosperous future resilient to all challenges.”