SHANGHAI — Huawei outlined its long-term chip plans for the first time on Thursday and said it would launch the world’s most powerful computing clusters – underscoring China’s drive to wean itself off foreign semiconductor suppliers like Nvidia (NVDA.O), opens new tab.

In an announcement that broke years of secrecy about its chips business and which could increase the stakes in the US-Sino war for tech supremacy, Huawei (HWT.UL) detailed timelines for its Ascend artificial intelligence chips and Kunpeng server chips.

Eric Xu, Huawei’s current rotating chairman, also revealed in a presentation that the company now has proprietary high-bandwidth memory – technology currently dominated by South Korea’s SK Hynix and Samsung Electronics.

“We will follow a 1-year release cycle and double compute with each release,” Xu told the annual Huawei Connect conference in the commercial hub of Shanghai.

China has in recent weeks stepped up efforts that target Nvidia, the world’s dominant AI chipmaker, while trumpeting domestic chip manufacturing.

Chinese authorities on Monday accused Nvidia of violating the country’s anti-monopoly law. The internet regulator has also ordered top tech firms to halt purchases of Nvidia’s AI chips and cancel existing orders, according to a Financial Times report.

Huawei’s announcement is likely to be seen as carefully timed for maximum impact ahead of a meeting by US President Donald Trump and Chinese President Xi Jinping on Friday. The meeting follows the conclusion of talks by US and Chinese trade negotiators this week.

“China is trying to say that they’re doing very well on many fronts … Xi Jinping will be more confident when speaking with Donald Trump,” said Alfred Wu, associate professor at the National University of Singapore.

“People assume that the situation is getting better, that everything is moving in the right direction, that US-China tensions will be eased to some extent but I’m thinking this is not the case, actually it’s quietly escalating.”

SUPERNODES

Huawei first announced plans to enter chipmaking in 2018. But it went dark about those efforts after it was sanctioned by the US in 2019, accused by Washington of presenting a national security risk. It denies that charge.

Since then, however, analysts say it has become a leader in Chinese efforts to develop a domestic semiconductor manufacturing industry.

Huawei just launched the Ascend 910C AI chip in the first quarter of this year. Its successor, the Ascend 950 will be launched next year and will come in two variants, Xu said. That will then be followed by the 960 version in 2027 and the 970 in 2028.

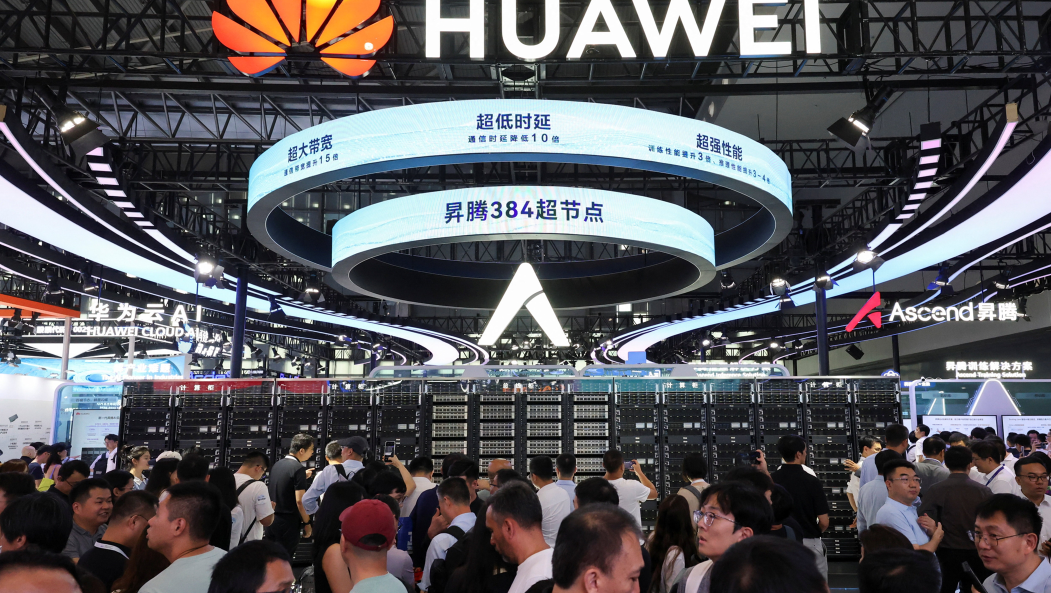

In addition, Huawei plans to roll out new computing power supernodes that allow chips to interconnect at high speeds. Nodes can be described as a rack system that contains numerous chips. Nodes are then grouped into clusters.

The Atlas 950 will be launched in the fourth quarter of 2026, supporting 8,192 Ascend chips. Xu said Huawei is confident that the Atlas 950 “will far exceed its counterparts across all major metrics”.

The Atlas 960, which will support 15,488 Ascend chips, will be launched in the fourth quarter of 2027.

The supernodes are successors to the Atlas 900, also known as the CloudMatrix 384, which uses 384 of Huawei’s latest 910C chips.

“Huawei is leveraging its strengths in networking, along with China’s advantages in power supply, to aggressively push supernodes and offset lagging chip manufacturing,” said Wang Shen, data center infrastructure practice lead at tech research firm Omdia.

New versions of Huawei’s Kunpeng server chip will also be launched in 2026 and 2028, Xu said.

Chinese semiconductor firms were up 2 percent in afternoon trade after the Financial Times reported that Chinese top tech firms had been ordered to halt purchases of Nvidia AI chips.