LONDON- China’s looming gallium export controls leave automakers with a dilemma over whether they can continue to rely on a metal which had been seen as a game changer for electric vehicles.

Gallium is currently used in a wide variety of applications, from LEDs to smaller mobile phone adaptors. Little known to most people, gallium in pure form can melt in your hand – but in a couple of compounds has become sought after for semiconductors.

Automakers are hungry for anything that boosts EV efficiency and reduces weight, helping them to cut costs. Gallium Nitride does both and is far cheaper than other semiconductor materials like platinum or palladium.

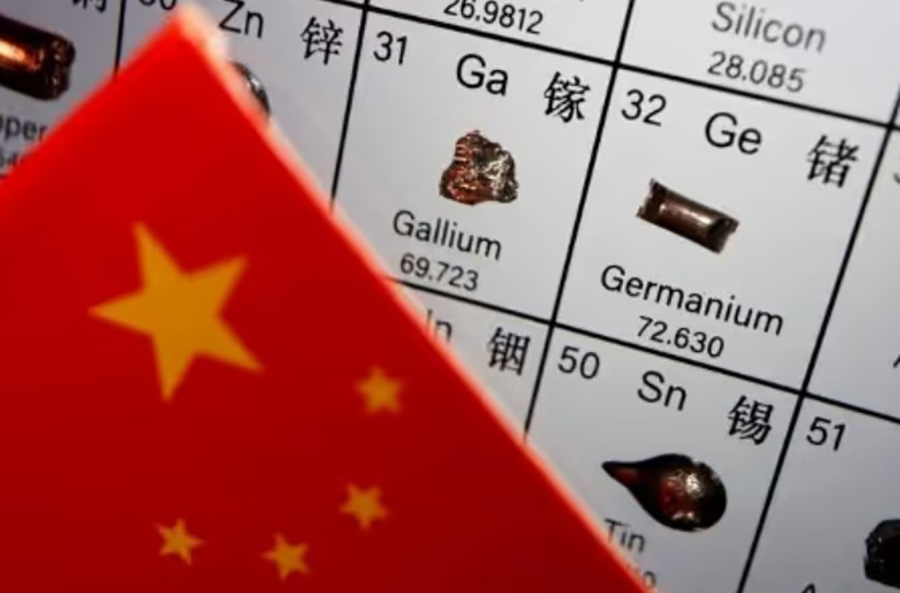

Gallium is found in trace amounts in zinc ores and in bauxite, and gallium metal is produced when processing bauxite to make aluminum. Around 80 percent is produced in China, according to the European industry association Critical Raw Materials Alliance (CRMA).

For EVs, the compound gallium nitride can handle a lot of power without generating heat – making it ideal for on-board chargers and possibly inverters, which help control the flow of electricity to and from the battery pack.

“Gallium nitride is a huge game multiplier,” said Umesh Mishra, co-founder at Goleta, California-based Transphorm which is developing chips using the compound.

Transphorm uses ultra thin layers of gallium nitride that are a micron, or one thousandth of a millimeter thick, on its semiconductors.

“You can either charge faster with the same footprint or if you want to charge at the same rate, you can do it in a much smaller point,” Mishra said.

Transphorm is working with automakers in the design phase for on-board chargers on a wide range of EV models – which should hit the market around 2026 – and is in conversations with others for using them in inverters, Mishra said.

But some mineral experts say China’s decision last week to impose export controls on gallium, along with another semiconductor material germanium, starting next month could force automakers to think again.

The auto industry is only now recovering from a pandemic-fueled global semiconductor shortage that forced automakers to halt production of some models and in some cases to leave unfinished vehicles standing waiting for a single chip.

Alastair Neill, a director at the Critical Minerals Institute, said that automakers who are in the early stages of designing their next generation of EVs could opt for silicon carbide, even though gallium nitride performs about 30 percent better, rather than risk a fresh supply chain headache.

“If you are already banking on gallium nitride and designing it into your platform, then you’re in trouble,” he said. – Reuters