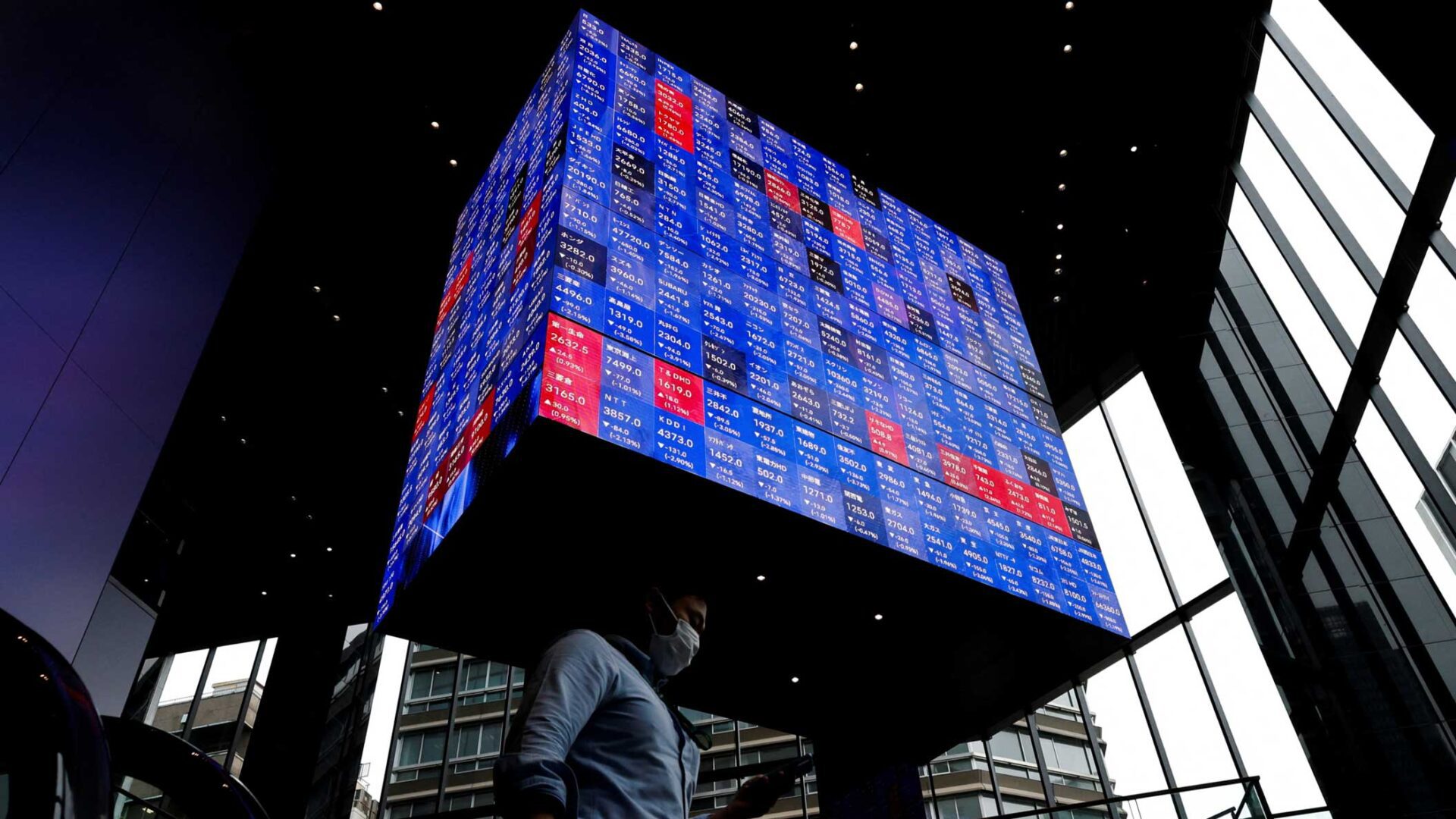

SINGAPORE — Asia stocks rose on Tuesday, buoyed by expectations of a US rate cut as early as next week, even as political upheavals around the world kept currency and bond investors on edge.

MSCI’s broadest index of Asia-Pacific shares outside Japan climbed 0.7 percent, taking its cue from Wall Street’s positive lead overnight that saw the Nasdaq index notch a record-high close.

Nasdaq futures were last up 0.06 percent, while S&P 500 futures similarly ticked up 0.05 percent.

European futures, meanwhile, eased after regional benchmark indexes clocked gains in the cash session on Monday.

EUROSTOXX 50 futures fell 0.2 percent, while FTSE futures and DAX futures dipped 0.13 percent and 0.26 percent, respectively.

Breathing new life into the equities rally were expectations that the Federal Reserve would ease rates when it meets next week, following Friday’s weak US jobs report.

While consumer and producer price inflation data are due in the week ahead, investors are betting that a 25-basis-point cut this month is a done deal, with focus now on whether the Fed could deliver a larger 50bp move.

The US Labor Department will also report a preliminary revision estimate to the employment level for the 12 months through March later in the day.

“Both publications are poised to influence the central bank’s pace down the monetary policy stairs,” said Jose Torres, senior economist at Interactive Brokers, referring to the PPI and CPI figures.