SINGAPORE- Asian stock markets and the dollar took a breather on Wednesday ahead of an anticipated rate cut in Canada and a US inflation reading expected to leave the Fed on course to cut rates again.

Investors were a touch cautious because, with an 85 percent chance of a US rate cut next week priced in and with Wall Street indexes around record highs, there is room for disappointment.

The S&P 500 had dipped 0.3 percent on Tuesday though it was just 65 points, or a little short of 1 percent shy of its all-time high.

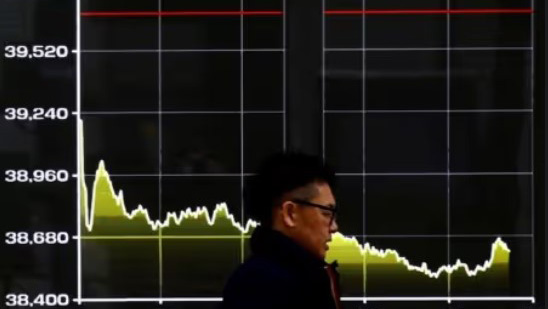

US futures rose 0.1 percent in the Asia session. European futures fell 0.2 percent and FTSE futures fell 0.4 percent. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.4 percent and Japan’s Nikkei was flat.

The median forecast of economists polled by Reuters is for headline and core US consumer prices increasing 0.3 percent month on month, for November. No forecasts were above 0.3 percent, which analysts say leaves markets vulnerable to a surprise.

“The 0.4 percent case is a barnburner,” said trader and president at analytics firm Spectra Markets, Brent Donnelly.

“The trade is to buy USD and sell stocks on 0.4 percent and do nothing otherwise.” The dollar is likely to rise if markets pare back the speed and depth of expected US rate cuts.

Analysts at the Commonwealth Bank of Australia think the dollar index will probably drift lower towards 105.1 if inflation meets expectations, but could shoot up towards 108.1 if core inflation comes in at 0.4 percent or higher.

The index was last at 106.4.