Bankers, markets and the entire business sector are all eyes on the Bangko Sentral ng Pilipinas (BSP) as the Monetary Board meets today to decide its next policy rate move.

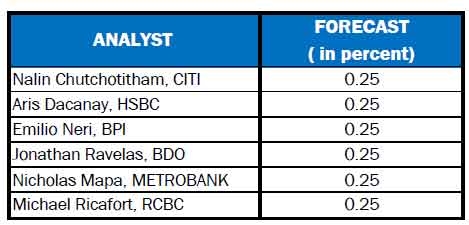

Given a steady inflation in January within the forecast range by the BSP, analysts interviewed by the Malaya Business Insight have reached a consensus that the Board will reduce its key rates by another 25 basis points, as shown by the table below.

The cut would be the fourth consecutive easing move by the Monetary Board, which would bring down the key rates to 5.5 percent.

Inflation, the key barometer used by the Monetary Board in determining the monetary policy action needed, remained relatively steady in January at 2.9 percent, as also recorded in December 2024.

BSP Governor Eli Remolona last month said, “We’re still in restrictive territory compared to what we think the ideal rate is … So there’s still some room to ease,” adding that monetary policy has a 12-18-month lag.

Jonathan Ravelas, BDO chief strategist, said any action today will be “a calibrated preemptive response to inflation.”

“I am looking at a 25 bps cut. But won’t be surprised to see a 50 bps cut on dismal growth numbers. You may recall, I called for a 50 bps last December. But they just did 25 bps,” Ravelas said in a Viber message.

Ravelas said that although January inflation at 2.9 was higher than his forecast of 2.5 percent, “it still gives BSP enough leeway to cut rates even by 50 bps to help spur economic growth.”

HSBC Asean economist Aris Dacanay, in a statement, said “inflation is not so much of a concern with the CPI well within the BSP’s 2-4 percent target band.”

“We expect the BSP to cut its policy rate by 25 bps to 5.50 percent. The concern is with growth and the engines that support it. Fourth quarter 2024 growth, at 5.2 percent, surprised on the downside, with household consumption, the country’s largest economic engine, underperforming. We think the BSP will loosen the monetary reins slightly to help support growth,” Dacanay said.

Although the Fed kept its monetary stance steady last month, Dacanay said they “do not think the BSP needs to do the same.”

“History has shown us that there is room for the policy rate differential between the Fed and the BSP to narrow from where it is today, especially since the saving-investment gap is at a more manageable level,” Dacanay said.

“Nonetheless, we think the BSP still needs to be mindful of Fed moves, more so with tariff risks complicating the easing cycle of the latter,” he said.

Emilio Neri, Jr., BPI lead economist, said they expect the BSP “to cut its policy rate by 25 bps, bringing the policy rate to 5.5 percent.”

“The central bank might use the slower-than-expected growth last quarter as the primary justification for the cut, along with a stable inflation environment that allows the central bank to focus more on boosting the economy,” Neri said in a statement.

“Recent statements from the BSP also suggest that economic growth will be a key factor in the Monetary Board’s decision. Governor Remolona recently noted that the country has a negative output gap and is operating below capacity. He added that a rate cut is on the table in the upcoming Monetary Board meeting, a signal that often precedes a policy action,” Neri said.

He said the recent stability of the peso could also provide the BSP with more room to consider a rate cut.

“While a rate cut could exert pressure on the peso, improving market sentiment may mitigate this. Moreover, the BSP might be open also to a higher exchange rate as long as inflation remains within target,” Neri said.

But although a rate cut remains on the table, Neri said the “extent of easing this year will be limited.”

“The sizeable current account deficit of the economy makes it more vulnerable to external shocks such as global trade tensions. A narrower interest rate differential could also drive portfolio outflows as investors seek higher returns elsewhere. In this context, interest rates could serve as a key buffer against market volatility,” Neri added.

“We therefore continue to expect a total of 50 bps in RRP rate cuts this year, which will bring the policy rate to 5.25 percent by year-end.”