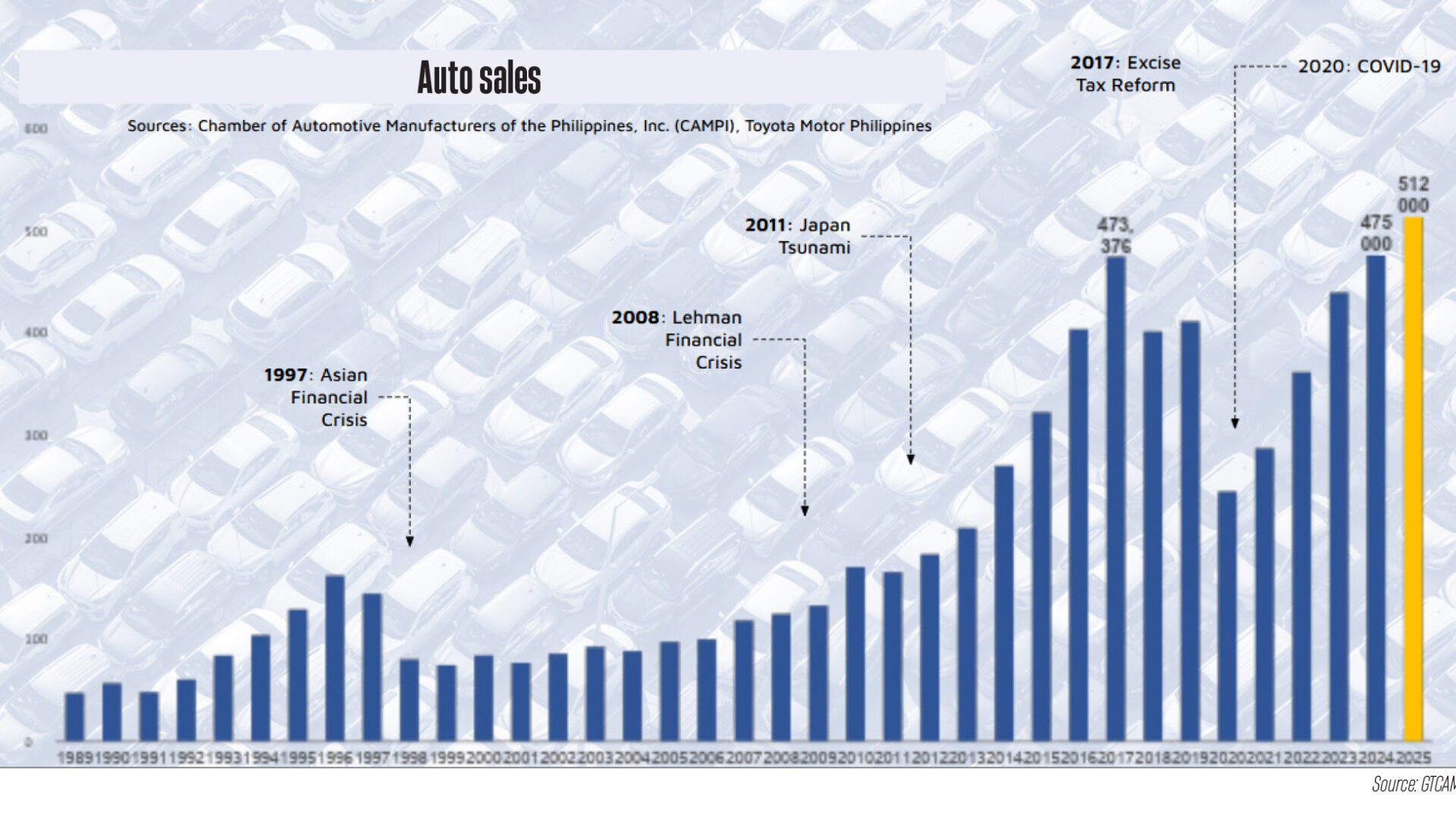

The Philippines remains on track to breach the 500,000-unit sales milestone for the first time this year, according to industry executives.

The optimistic forecast emerged in two separate interviews on July 25, even as three typhoons battered Metro Manila and much of Luzon.

GT Capital Auto and Mobility Holdings Inc. Chairman Vicente Socco said his outlook hinges on the stabilization of geopolitical and geo-economic events in the second half of the year.

“This will place the country on par with Indonesia, Thailand, and Malaysia—markets that have already surpassed the half-million mark,” Socco said in his speech at the Auto Parts and Vehicles Expo 2025.

In a separate interview, Rommel Gutierrez, president of the Chamber of Automotive Manufacturers of the Philippines Inc. (CAMPI), called the 500,000-unit target an “aspirational figure.”

Gutierrez said vehicle sales rose 1.7 percent in the first five months of 2025 to 190,429 units, up from 187,191 units in the same period last year.

Data from the ASEAN Automotive Foundation showed that in 2023, Indonesia topped 1 million units sold, while Malaysia reached 799,731 units, Thailand 775,780 units, and the Philippines 429,807 units.

Socco said strong macroeconomic fundamentals—including a GDP growth rate averaging 6 percent from 2005 to 2019—continue to fuel vehicle demand in the Philippines.

“Post-COVID, growth has returned, though somewhat tempered by global uncertainties. Nonetheless, it’s still faster than most,” Socco noted.

He added that improved access to consumer credit is also driving automotive sales.

At the micro level, Socco pointed to the growing interest in and expanded availability of electrified models, which are opening up new market segments. In 2019, the share of alternative energy vehicles was negligible. It rose to 5.1 percent by 2024 and climbed further to 9.2 percent as of May this year.

The proliferation of original equipment manufacturers (OEMs) in the country has also boosted product variety and stimulated demand.

“There are around 50 different brands competing for a share of the Philippine market,” Socco said.

He further observed that a shift in consumer behavior—from car ownership to car usership—is creating fresh demand for connected, shared, and electrified mobility solutions.

Socco cited a study by Focus2Move at the start of the year which found that the ASEAN vehicle market ranked as the world’s fifth largest sub-regional market, with 3.3 million units sold in 2023 and slightly fewer at 3.2 million in 2024.

In the same study, regional motorization rates varied widely, averaging 113 vehicles per 1,000 population in 2022. Brunei topped the list with 605 vehicles per 1,000 people, followed by Malaysia with 533, Thailand with 290, Singapore with 148, Indonesia with 87, the Philippines with 48, and Vietnam with 44.