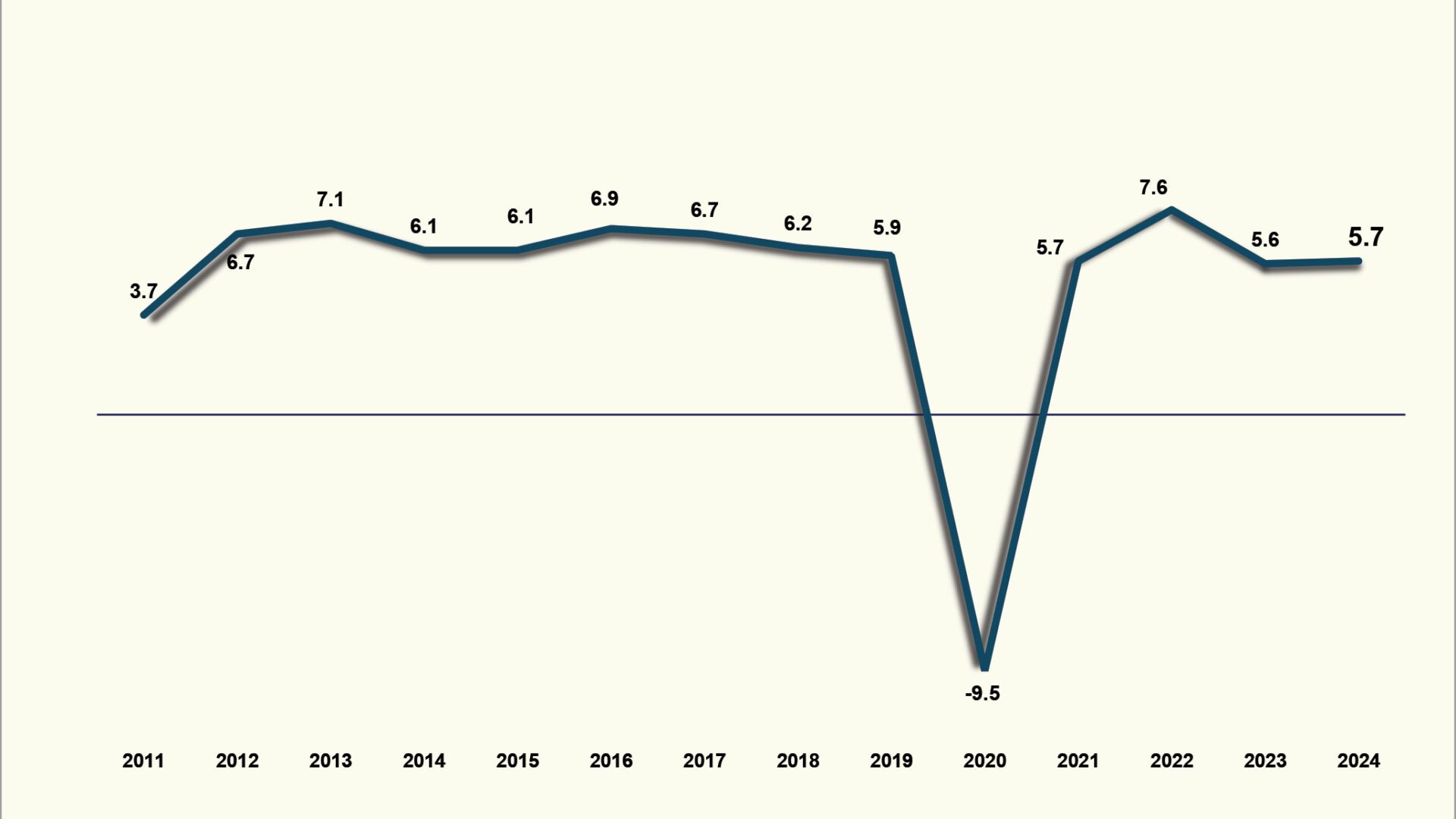

Security Bank has revised its 2025 GDP growth forecast for the Philippines down to 5.6 percent from 5.9 percent, citing risk from the ongoing trade war, oil price shock from the Mid-East conflict and persistently adverse weather conditions.

Standard Chartered, meanwhile reduced its growth forecast for the country’s economy to 6 percent from an earlier estimate of 6.5 percent.

In an investor note, Security Bank economists Angelo Taningco and Chino Genuino also pointed to the slowdown in public construction due to the recent election ban and headwinds for agriculture and manufacturing from rising US tariffs.

The bank now expects third and fourth quarter GDP growth rates to average just 5.8 percent, down from 6 percent previously.

“This downward revision stems in part from US President [Donald] Trump’s recent pronouncements on imposing a 19 percent tariff on Philippine exports and calls for the Philippines to provide ‘open market’ access and ‘zero tariffs’ on US goods,” the note said.

The economists also cited President Ferdinand Marcos Jr.’s commitment to eliminate tariffs on US vehicles, and increase imports of soy, wheat, and pharmaceuticals, as part of the recent bilateral deal — a move that could further widen the country’s trade deficit with the US.

“New tariff measures would dampen Philippine exports, increase US imports, and narrow the trade surplus — all of which will weigh on overall growth,” the economists’ note said.

Within govt forecast range

In a media briefing over the weekend, Standard Chartered Bank’s Asia economist

Jonathan Koh said he expects Philippine GDP to still grow within the government’s downscaled target of 5.5 to 6.5 percent.

StanChart cited a weaker labor market, but at the same time it sees moderating inflation and a potential monetary policy pivot.

The bank also sees the Bangko Sentral ng Pilipinas (BSP) cutting policy rates by a total of 75 basis points before year-end, bringing the benchmark rate to 4.5 percent.

Koh, who is also Standard Chartered’s forex strategist, said the BSP could begin easing as early as August 28, followed by cuts in October and December, amid signs of cooling inflation and policy space for growth support.

He also sees inflation averaging 1.8 percent in 2025 — slightly above the BSP’s 1.6 percent forecast but still below its 2 percent floor — and the peso settling at 57.50 to the dollar by year-end.

Growth faces headwinds

The Asian Development Bank (ADB) and ASEAN+3 Macroeconomic Research Office (AMRO) have also trimmed their outlook for the Philippines, warning of growing external uncertainties.

In its July update, the ADB cut its 2025 growth projection to 5.6 percent, from 6 percent, and lowered its 2026 forecast to 5.8 percent from 6.1 percent, citing sustained geopolitical tensions and the impact of US trade policy on Asia’s export outlook.

AMRO, for its part, now sees Philippine growth at 5.6 percent in 2025, down sharply from its earlier estimate of 6.3 percent. The 2026 forecast was also revised down to 5.5 percent.

“The region’s outlook remains fraught with high uncertainties,” AMRO said, citing US protectionism, tight global financial conditions, and commodity price volatility as persistent risks.

Despite these headwinds, Philippine economic managers have maintained their growth target of 5.5 to 6.5 percent for 2025, banking on strong domestic demand, infrastructure spending, and a more accommodative monetary stance to support recovery.