Local petroleum retailers have announced pump price increases for their fuel products, with gasoline now up by P1.10 per liter, and both diesel and kerosene up by P0.40 per liter, effective 12 am today, March 25.

Seaoil and Caltex increased pump prices of gasoline by P1.10 per liter and both diesel and kerosene by P0.40 per liter.

Jetti, PTT and Clean Fuel are imposing the same price increases for gasoline and diesel. The three do not sell kerosene.

This is the first across-the-board fuel price hike for petroleum products after three consecutive weeks of price rollbacks.

Prior to these increases, total price reductions for three weeks have totaled P2.60 for gasoline, P2.50 for diesel and P3 for kerosene.

An independent fuel retailer said the adjustments have been made due to worsening geopolitical tensions in the Middle East, which have pushed global risk premiums higher, and which in turn, have elevated concerns over sustainability of oil supply.

Latest data from the Department of Energy (DOE) showed that Manila’s current prices per liter of gasoline (RON91) are at P55.50, diesel at P53.70, and kerosene at P70.67.

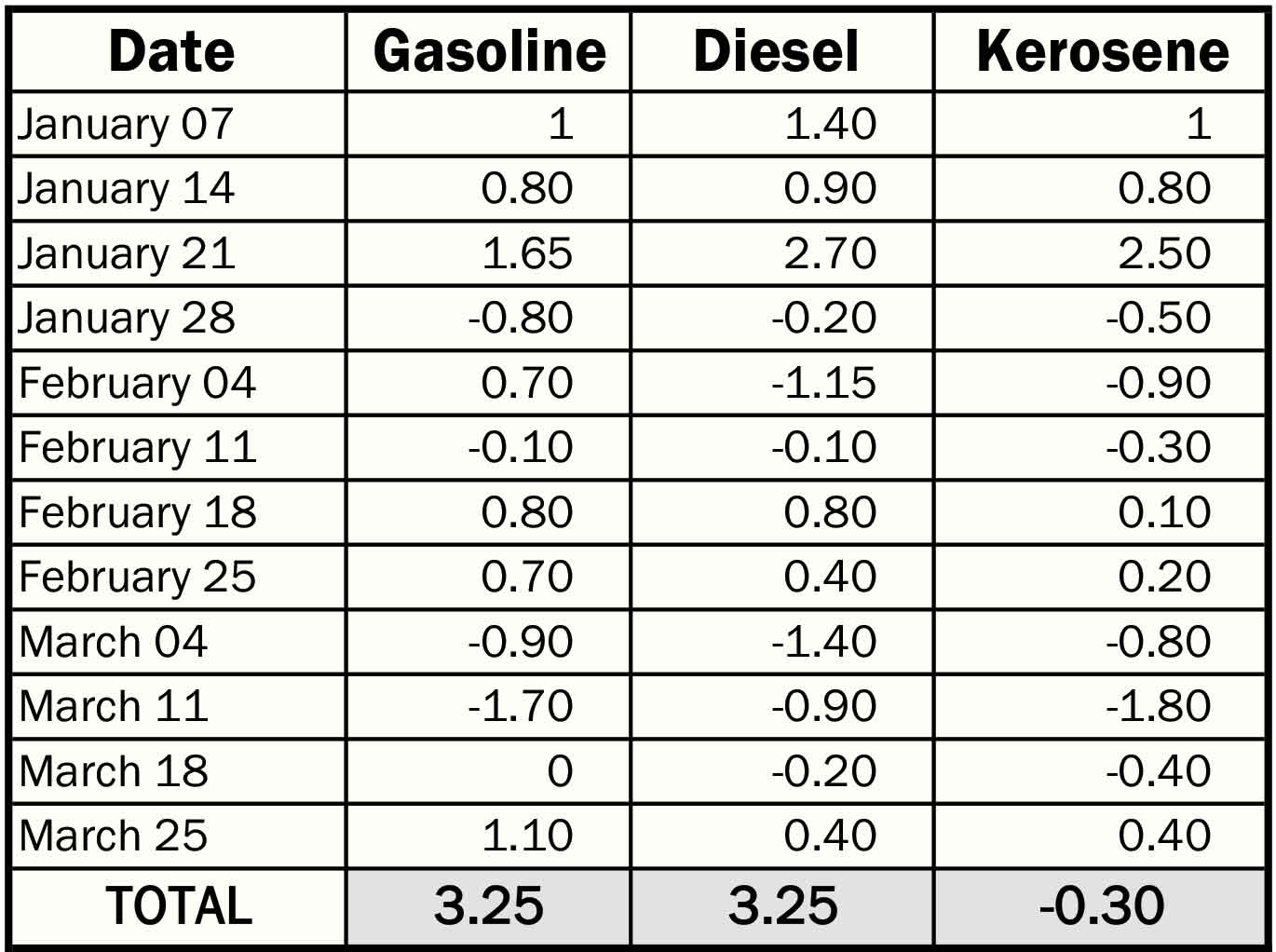

As of March 18, the DOE has recorded a total net increase of P2.15 per liter for gasoline and P2.85 per liter for diesel but a net decrease of P0.70 per liter for kerosene in the year-to-date.

Leo Bellas, Jetti Petroleum Inc. president, told reporters increases in fuel prices this week were also influenced by China’s provisions of an economic stimulus, which may prop up demand for fuel.

China is currently the biggest buyer of petroleum products in the world.

But Bellas also pointed to several other factors that could hold off further increases.

“[However], the strong dollar against a basket of currencies, US Central Bank’s decision to hold interest rates steady, the renewed prospects of a Russia-Ukraine ceasefire and recession fears due to the tariff wars have been holding oil prices back,” Bellas explained.

Traders know that when the US dollar is strong, it becomes more expensive to buy fuel using other currencies.

Meanwhile, Rodela Romero, DOE’s Oil Industry Management Bureau director, agreed with the factors mentioned by Bellas.

Romero added the US government also released data showing fuel inventories drawdown, or a faster rate of fuel consumption than the pace of fuel supply replenishment.