Property consultant Jones Lang LaSalle (JLL) expects the stream of new retail spaces coming online in the metro in the coming months, keeping rent inflation tame.

Janlo delos Reyes, JLL head of research, said while there are new spaces coming on line, vacancies are recorded due to closures with local brands leading the pack on “tightness and competition” relative to foreign brands which are entering and expanding their presence in the metro.

Delos Reyes said rents could stay at a range of between P1,605 and P1,750 compared to the average P1,746 at present.

This despite what JLL sees as a “steady demand coming from retailers.”

“We don’t see any movement as mall developers and operators are maintaining their rents to continue attracting tenants. We forecast rents to decline slightly by end of the year because we’re expecting again the new supply that will enter the market and they will likely have lower rentals initially upon launch or upon opening but this will increase eventually over the next couple of quarters as this will be taken out by retailers,” he said.

JLL recorded a total of 34,911 square meters (sq.m.) that went online in the second quarter of the year, up 11.84 percent from the first quarter’s 31,215 sq.m.

JLL recorded a total of 34,911 square meters (sq.m.) that went online in the second quarter of the year, up 11.84 percent from the first quarter’s 31,215 sq.m.

Developers are moving to address the demand of brands like Nitori, Giordano, Handyman, Muji, Mesa, Uniqlo and others, delos Reyes said.

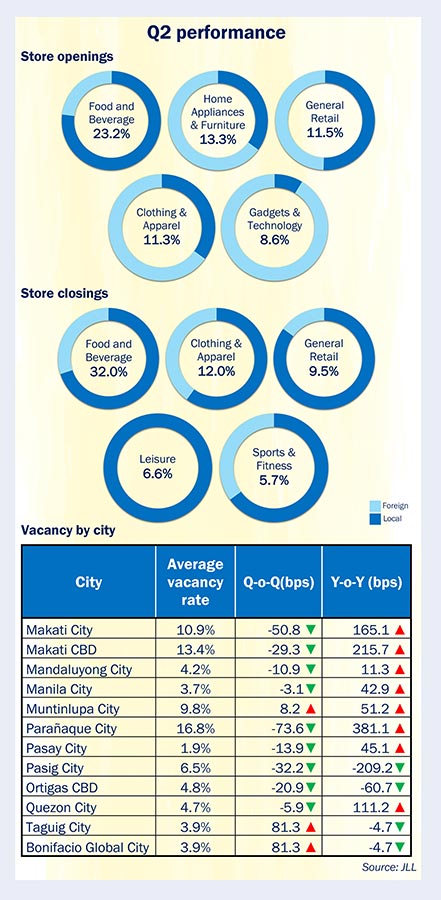

Food and beverage brands continue to lead the demand for more spaces, cornering 23.2 percent of transacted space, followed by home appliances and furniture stores, and general retail – at 11.5 percent – for the top three.

“Majority of the new store openings are expansion of existing brands. But we’re also seeing firms serving some new brands entering the market coming from the foreign brands such as the Nitori of Japan… that have entered the market over the past couple of quarters,” delos Reyes said.

He said majority of new retail spaces opening are located in Quezon City and Makati where a total of 17,682 sq.m. and 15,721 sq.m. of spaces were opened by mall developers – which he described as “quite robust” given the concentration of shopping malls in the locality.

The opening of new malls pulled down the vacancy rate for retail space in the metro to 6.3 percent from the previous quarter’s 6.5 percent, he added.

“Specifically, we observed that Gateway mall in Quezon City saw a significant decline in vacancy to around 29 percent in the second quarter of 2024. The mall recently opened a new area, which has a high occupancy rate of around 88 percent,” he said.

JLL noted that in terms of vacancy rate, Parañaque retail space has the highest average vacancy at 16.8 percent, followed by Makati City at 10.9 percent and Muntinlupa City at 9.8 percent.

JLL expects vacancy to slightly increase towards the end of the year with the additional 123,000 sq.m. of space from new shopping malls entering the market.

“This will take time to get filled up despite this steady takeup of retailers,” he said.

This is particularly notable given the approaching spending season in the fourth quarter when retailers work to have their businesses open, he added.