RCBC, a leading digital challenger bank, introduced QR-based cardless withdrawals via RCBC ATM Go. This move supports the bank and the Philippine government’s goal of enhancing financial inclusion by making digital financial services more accessible in underserved regions.

RCBC ATM Go, a versatile digital solution, offers basic banking services like cash deposits and withdrawals, bill payments, and government benefits claims through SIM-powered mobile-point-of-service (mPOS) devices. It’s widely used in remote areas such as Turtle Island and Lake Sebu, addressing banking needs in underserved communities.

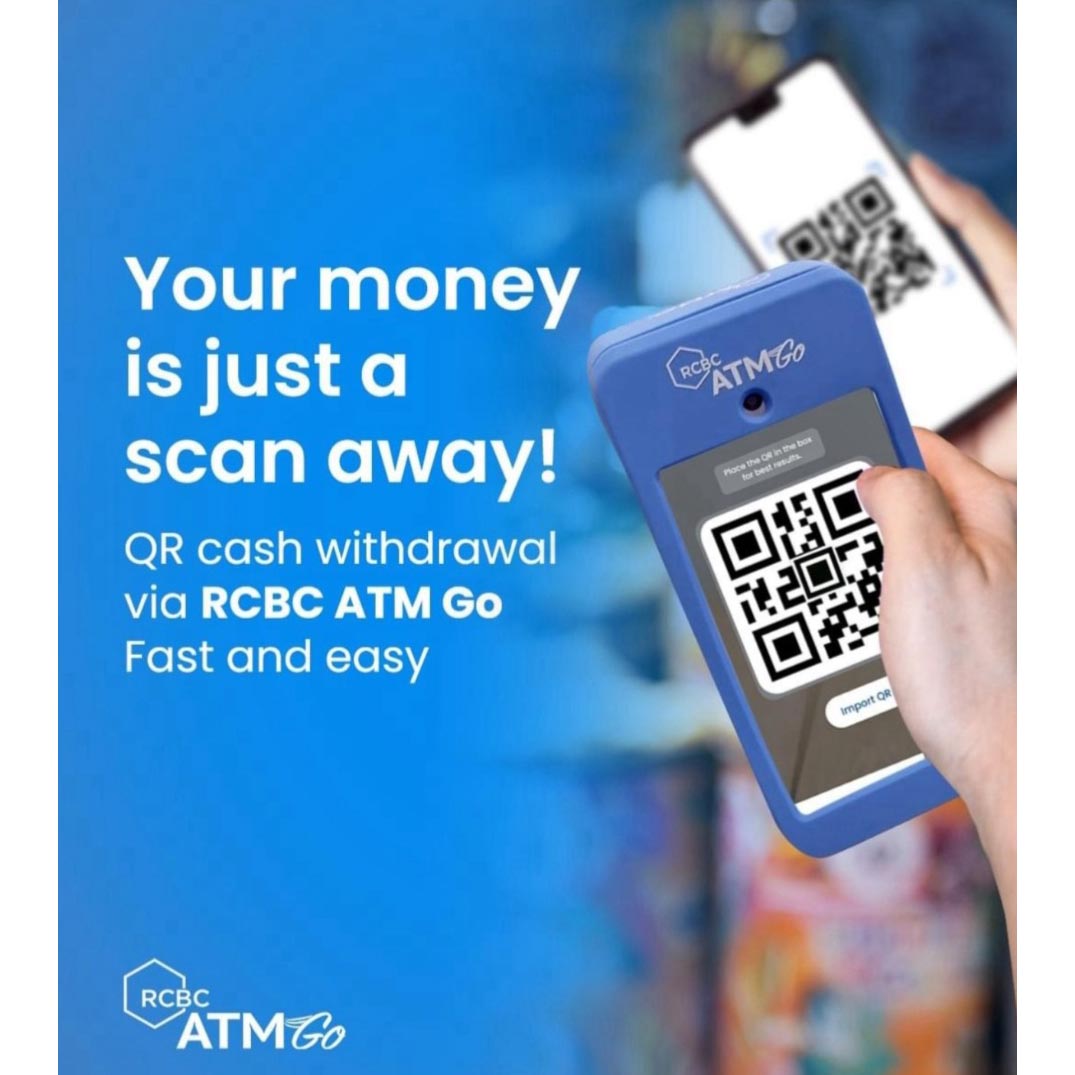

To withdraw money, customers can visit nearby RCBC ATM Go partner merchants. They initiate transactions using the RCBC ATM Go device, selecting “Withdraw” and then “Without Card” before opting for “QR Cashout.” Using their smartphones and RCBC’s scanning apps, customers generate and scan QR codes to complete transactions.

Lito Villanueva, RCBC’s executive vice president, sees QR-powered cash withdrawals as a significant step towards digitalization in the Philippines. He believes it will reduce the need for rural Filipinos to travel to urban areas for banking services, supporting financial inclusion efforts.

RCBC remains dedicated to the government’s vision of financial inclusion. Villanueva hopes this innovative service will encourage more Filipinos to embrace formal banking, benefiting both individuals and local businesses.