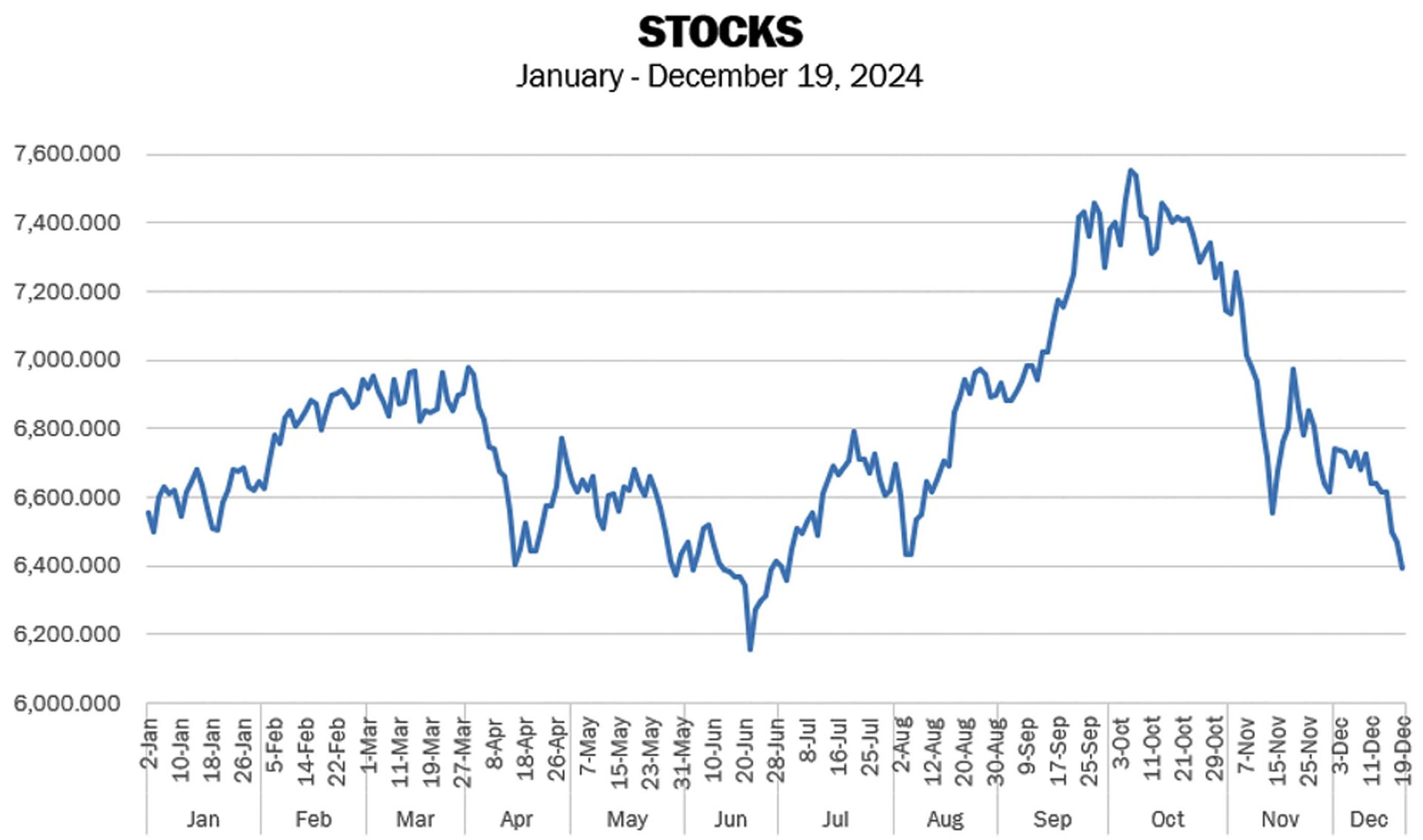

Philippine shares tracked the slide on Wall Street and regional markets, wiping out gains recorded for the year in a fifth-day slump, which analysts said gave a glimpse into a challenging year ahead for the capital market.

Investors modified their expectations following the US Federal Reserves’ revision of forecast of a series of rate cuts to two instead of four previously, dragging Wall Street down overnight.

The Philippine Stock Exchange index (PSEi) fell 73.48 points or 1.14 percent to settle at 6,395.60. In 2023, the index closed the year at 6,450.04.

In Thursday trade, the broader All Shares index was down 28.25 points or 0.76 percent at 3,671.75.

Losers led gainers 126 to 72, with 41 stocks unchanged. Trading turnover reached P6 billion.

Astro del Castillo, managing director at Regina Capital and Development Corp., said Thursday’s trade provides a glimpse into the “challenging year” ahead for the financial capital market.

“Given the new admin in the US, the geoeconomic landscape will be different, affecting the capital market. Will there be a trade war? Will it affect the market?” said del Castillo.

“You already saw a glimpse of what could happen next year; we’re back to a level (seen) last year,” he added.

Foreign funds net sellers

Foreign funds, which constitute a big chunk of the daily trading volume, were net sellers of shares worth P24.69 billion, Japhet Tantiangco, analyst at Philstocks Financial Inc., said.

For the rest of the sessions in 2024, things could hopefully still be lifted by a “Santa Claus rally,” Tantiangco said, referring to a more upbeat sentiment around the Christmas period.

“The year is not yet over, so there is still that possibility, he said, but added a cautious note: “However, given the bearish technicals that our market has, together with the present concerns (i.e. President-elect Donald Trump’s planned protectionist policies, less rate cuts expected from the Fed, weak peso), I would say that the probability of a Santa Claus rally is very low.”

The peso closed at 59 to the dollar, softer than 58.99 recorded on Wednesday. The currency opened at 59, an intraday high, hitting a high of 58.98. Trading turnover reached $1.1 billion.

The Bangko Sentral ng Pilipinas (BSP) announced after the stockmarket’s closing bell a rate cut of another 25 basis points, bringing the key policy rate to 5.75 percent.

Overnight on Wall Street, Powell said more reductions in borrowing costs now hinged on further progress in lowering stubbornly high inflation. Reuters reported.

The hawkish tilt from the Fed sent traders heavily dialling back easing expectations next year and pushed the dollar to a near two-year peak, it said.

“Powell’s pivot back to price stability risks has seen the markets rapidly unwinding expectations on further cuts next year, pushing yields and the US dollar higher, and tightening financial conditions meaningfully across the globe – kryptonite for EM asset prices,” Kyle Rodda, a senior financial market analyst at Capital.com, was quoted as saying.

South Korea’s won, which had already been weighed down by domestic political turmoil, dropped 1 percent to its weakest level in 15 years.

The Indian rupee fell past 85 to the US dollar for the first time, while the Malaysian ringgit eased 0.8 percent.

The Indonesian rupiah slid more than 1 percent in its seventh straight session of losses, despite the central bank holding interest rates steady as it focused on supporting the currency.

Bank Indonesia said it would act to stabilize the currency against any excessive volatility, while Thailand’s central bank said it will ensure that the baht is not too volatile. The Reserve Bank of India is seen likely intervening to support the rupee.

Maybank analysts cautioned that the dollar rally faces downside risks in the near term, as markets often overshoot after the Fed’s validation, only to be corrected by subsequent data.

Dampener to 2025 sentiment

Jonathan Ravelas, managing director at emanagement for Business and Marketing Services (EMBM), said he was hoping the BSP would cut its key rate by 50 basis points, instead of the widely expected 75 basis points, in its last meeting to give the local economy an upside momentum next year.

Ravelas said that given the backdrop of a subdued outlook for a rate cut in the US, it had been expected that the local policymakers might also limit their policy cut to just 50 basis points next year.

“Given the slow third-quarter economic growth of the Philippines, investors might find it hard to justify investing in the Philippines compared to elsewhere,” he said.

Most actively traded Bank of the Philippine Islands was down P4 at P122. Ayala Land Inc. lost P1.05 to P24.90. BDO Unibank Inc. gained P5 to P148. International Container Terminal Services Inc. slipped P4 to P385, while SM Prime Holdings Inc. shed P0.20 to close at P24.90.