The Philippine economy is expected to gain mometum in the second half of 2025 on the back of resilient household consumption and a potential rebound in private investment, market analysts said over the weekend.

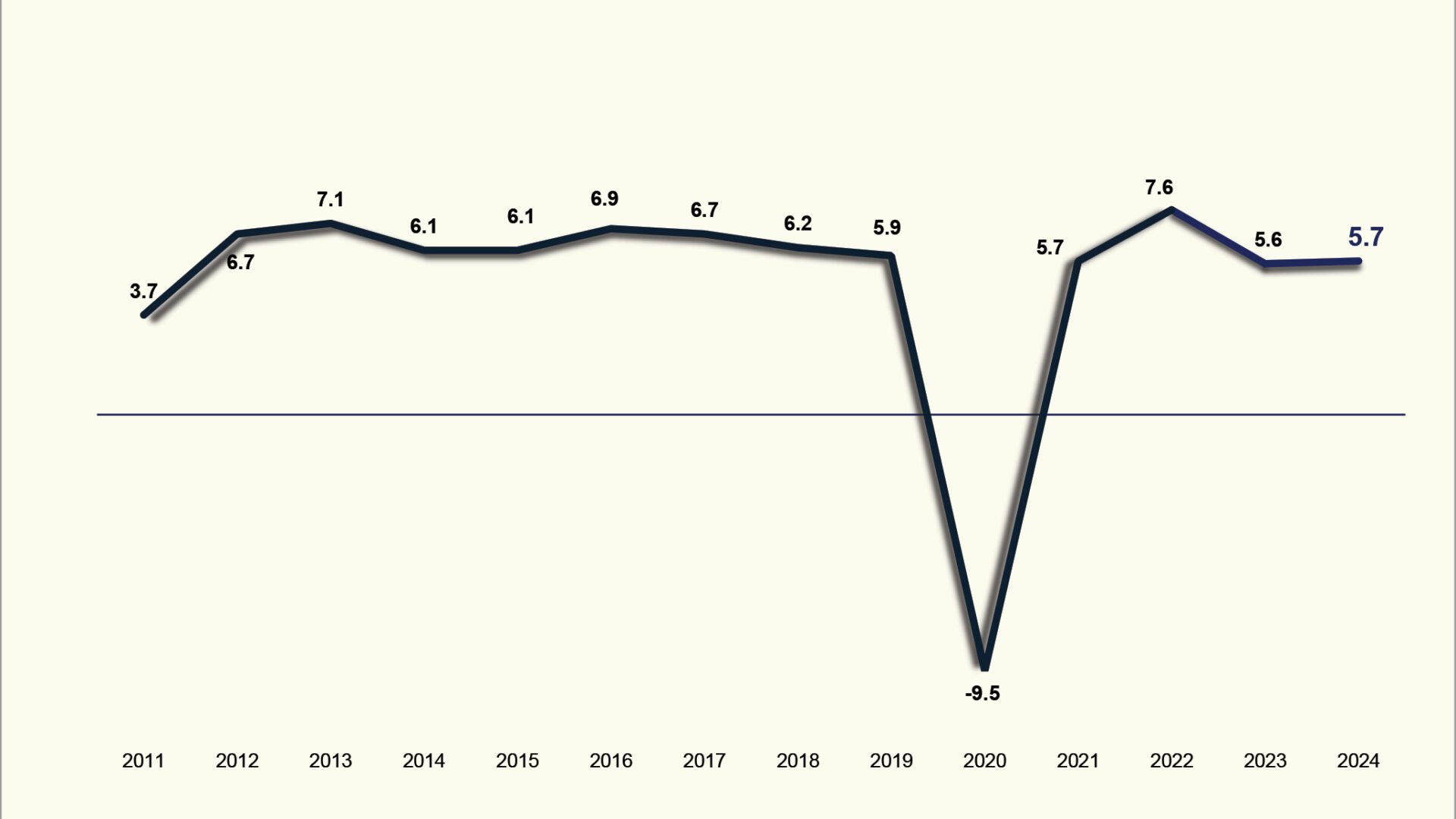

They made the assessment after the government reported last week that gross domestic product grew 5.5 percent year-on-year in the second quarter. The April-to-June pace brought the first-half gross domestic product (GDP) growth to 5.4 percent.

This is also lower than the Philippines’ full-year 2025 growth target of 5.5 to 6.5 percent.

Luis Limlingan, managing director at Regina Capital Development Corp., said the second-quarter data reflected solid domestic consumption and a pickup in exports.

“Moving forward, with tariffs in effect, many will be watching whether this can hold — and whether private investment will continue despite geopolitical tensions,” he said.

Risk remains

Ronald Joseph Lantin, fund manager at Insular Life, said household spending remained strong on easing inflation, though risks remain. “Severe typhoons and global supply chain issues could cause a relapse,” he warned.

Jonathan Ravelas, managing director at eManagement for Business and Marketing Services, noted that cooling inflation and steady remittances are supporting household spending.

“That’s a good sign for consumer-driven sectors,” he said, but cautioned that private investment remains “dragged by global uncertainties like US tariffs and supply chain risks” — a “red flag for long-term growth.”

He urged stakeholders to “double down on consumer confidence, unlock private investments, and leverage agriculture momentum,” adding that the absence of an election-related public works ban in the second half should allow infrastructure spending to rebound.

Push, not pause

“The second half is crucial — it’s time to push, not pause,” he said.

Last week, National Statistician Claire Dennis Mapa said the gross national income rose 8.2 percent, boosted by a 32.8 percent jump in net primary income from abroad. On a seasonally adjusted basis, GDP grew 1.9 percent, while GNI expanded 2.3 percent.

By sector, agriculture surged 7 percent year-on-year, services grew 6.9 percent, and industry rose 2.1 percent.

Seasonally adjusted, services led with 2 percent growth, followed by agriculture at 1.7 percent and industry at 0.5 percent. The economy’s total value stood at P6.96 trillion at end-June.

In a note after the GDP report was released last Thursday, Security Bank said it expects the Bangko Sentral ng Pilipinas to cut policy rates by a total of 50 basis points this year — 25 in August and another 25 in December — bringing the terminal rate to 4.75 percent.

“The latest GDP print suggests the need for more monetary accommodation to attain the government’s full-year target,” the bank said, reiterating its 5.6 percent full-year growth forecast on the back of “benign inflation, lower interest rates, and improved household consumption and capital formation.”

On Friday, a day after the Philippine Statistics Authority released the second-quarter GDP data, the stock market’s benchmark PSEi rose 0.53 percent to close at 6,339.38, while the broader All Shares gained 0.42 percent to 3,767.41.