Philippine manufacturing output showed modest improvement in July but continues to face strong headwinds from geopolitical tensions, volatile oil prices and the ongoing US trade war, economists said over the weekend.

Global inflation and slowing trade are expected to result from rising oil prices amid sustained tensions from the Middle East and the global trade war, which could also weigh down local manufacturing, they said.

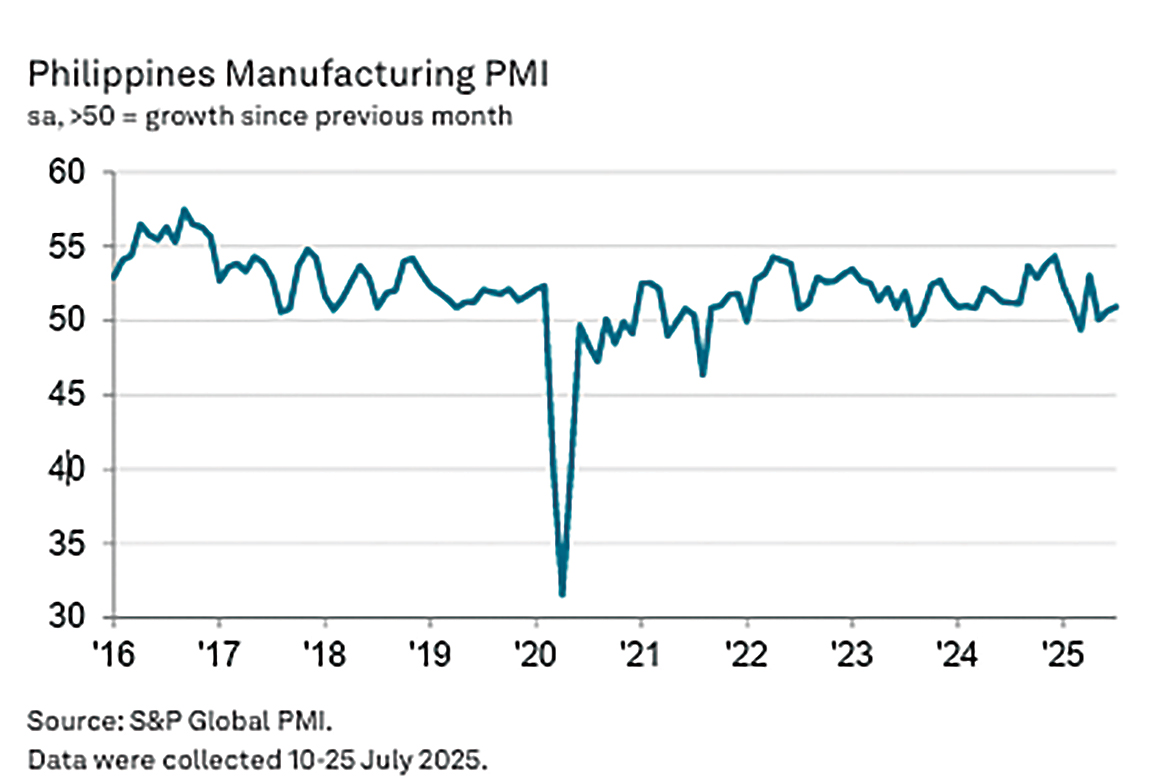

Data released late last week showed the S&P Global Philippines Manufacturing PMI edged up to 50.9 in July, slightly higher than 50.7 in June and 50.1 in May, indicating a mild expansion in factory activity.

However, the reading is still weaker than the comparative 51.2 recorded in July last year.

“The improvement in operating conditions was the strongest since April,” S&P Global said, though it added that output and new orders rose at only modest and historically muted rates.

Growth in hiring and purchasing also lost momentum.

Business confidence, however, climbed to a four-month high, with firms optimistic about future production levels.

“Inflationary pressures were notably muted,” Maryam Baluch, economist at S&P Global Market Intelligence, said, calling this a “silver lining” in an otherwise cautious outlook.

Front-load orders

Some manufacturers ramped up inventories in anticipation of future demand — particularly to front-load orders from the US ahead of impending tariff hikes.

This resulted in the strongest build-up in post-production inventories in eight months, S&P said.

New export orders also increased for the first time in five months, albeit marginally.

Michael Ricafort, chief economist at Rizal Commercial Banking Corp., said over the weekend rising oil prices due to the Israel-Iran conflict and escalating US trade barriers could fuel global inflation and slow down trade — both of which pose risks to Philippine manufacturers.

Ricafort noted that July’s expansion aligned with the seasonal ramp-up in production and importation typical of the third quarter, as companies prepare for the fourth quarter’s holiday demand.

Economy partly cushioned

Ricafort said the global headwinds may be blunted by the Philippines’ consumption-driven economy, which remains one of Southeast Asia’s fastest-growing and is less dependent on merchandise exports than its Asean neighbors.

He also cited supportive monetary policy as a tailwind, including 1.25 percentage points in policy rate cuts by the Bangko Sentral ng Pilipinas (BSP) since August 2024, 1 percentage point in US Fed cuts since September 2024, and a lower reserve requirement ratio for banks.

However, Ricafort also pointed out that the recent peso depreciation to the P58 level — near five-month highs — could push up input costs for local producers.

“While this may hurt importers, it could benefit exporters,” he added.

Looking ahead, Baluch said the PMI data “painted a picture of a muted overall performance” but hinted at a more hopeful outlook given improving sentiment and strategic preparations for future demand.

Local banks’ forecasts: Optimism softens

Meanwhile, forecasts from local banks suggest the broader economy maintained resilience in the second quarter, and although individual businesses may sustain hope for the immediate future, the optimism somehow has softened.

In its latest Wealth Insights report, Metrobank projected 5.6 percent GDP growth, citing improved business sentiment and a boost in private consumption during the midterm election season, despite a dampened overall consumer outlook based on BSP’s Consumer Expectations Survey.

The BSP’s Business Expectations Survey also showed a better outlook for individual firms’ operations, even if optimism about the broader economy has softened.

Security Bank shared the 5.6 percent estimate and pointed to a 16.2 percent narrowing of the trade deficit to a five-quarter low of $11.6 billion, driven by 16 percent export growth outpacing 2.1 percent import growth in the second quarter.

However, it warned that higher global tariffs could reverse the trend in the second half, moderating exports and boosting imports, thereby widening the trade gap once again.