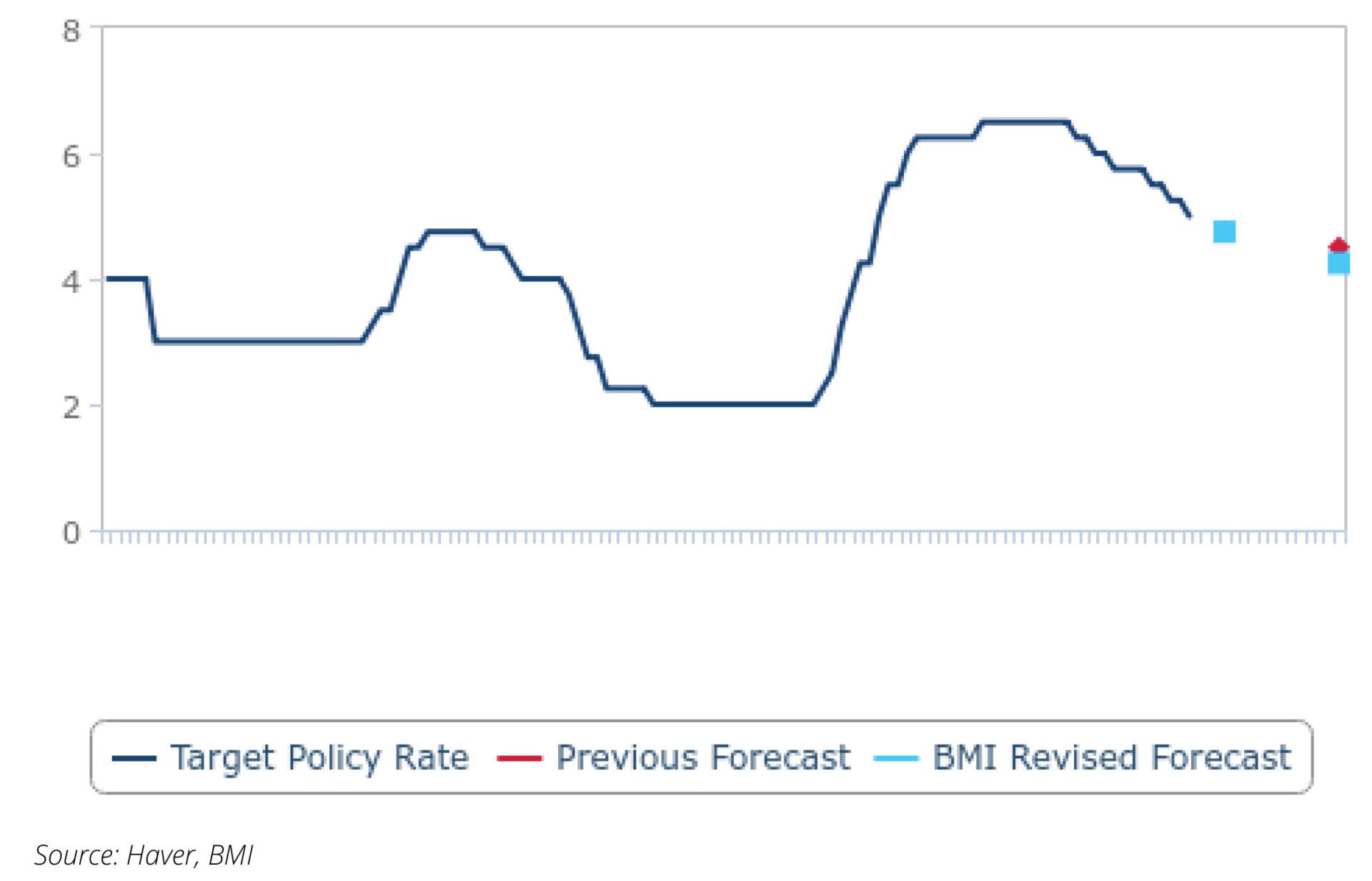

The Bangko Sentral ng Pilipinas (BSP) may be lowering its key policy rate down to 4.25 percent by end-2026, with inflation easing within target and the peso broadly stable, BMI Country Risk & Industry Research said in its latest outlook.

In an August 29 report released Monday, BMI, the Fitch Solutions unit, projected a 25-basis-point (bps) cut in December, followed by a further 50 bps in 2026.

BMI expects the BSP to keep its current setting in October, after Governor Eli Remolona Jr. described the monetary stance as a “sweet spot” with inflation contained and growth steady.

The central bank has already reduced its reverse repurchase (RRP) rate by 75 bps this year, including the latest move on August 28. Since the start of its easing cycle in August 2024, cumulative cuts have reached 150 bps.

BMI raised its 2026 forecast for rate cuts from 25 bps to 50 bps, citing expectations of average inflation at 2.5 percent and a peso trading at P58 to the dollar by end-2025 and P58.50 by end-2026.

Rates to ease

“All things considered, we think BSP will maintain its policy rate at 5.00 percent in October and proceed with a 25 bps cut in December. Easing inflationary pressure towards the end of 2025 will provide the central bank with the space to cut,” BMI said.

For 2025, BMI sees inflation averaging 1.6 percent, slightly below BSP’s forecast of 1.7 percent. Even with potential pressure from electricity rate hikes and rice tariffs, BMI said slower growth momentum should keep prices contained.

By end-2025, the policy rate is expected to settle at 4.75 percent and ease further to 4.25 percent by end-2026. BMI flagged weak remittances and tariff uncertainty as possible drags on growth.

Economy in ‘sweet spot’

At a Senate budget hearing Monday, Remolona highlighted sharp disinflation, with July inflation at 0.9 percent — negative for the poorest households. He said monetary easing had supported demand without stoking price risks.

“We think the economy is in good shape. Inflation has been tamed, the banking system remains strong, and our external position is sound. Indeed, our economy is in what I would call a sweet spot,” he told senators.

Remolona pointed to a resilient banking sector, with non-performing loans steady at 3 percent and foreign reserves at $105 billion.

BMI projects Philippine growth at 5.4 percent in 2025 and 5.2 percent in 2026, below the government’s 6–7 percent target.

“We see risks to our forecast as skewed toward more rate cuts,” BMI said, warning that a global tariff war could sap consumer and investor confidence. “If such a scenario materialises with inflation expectations anchored, the BSP would prioritise the economy and implement larger policy rate cuts.”