Corruption outcry being monitored for potential heightened risk –country director

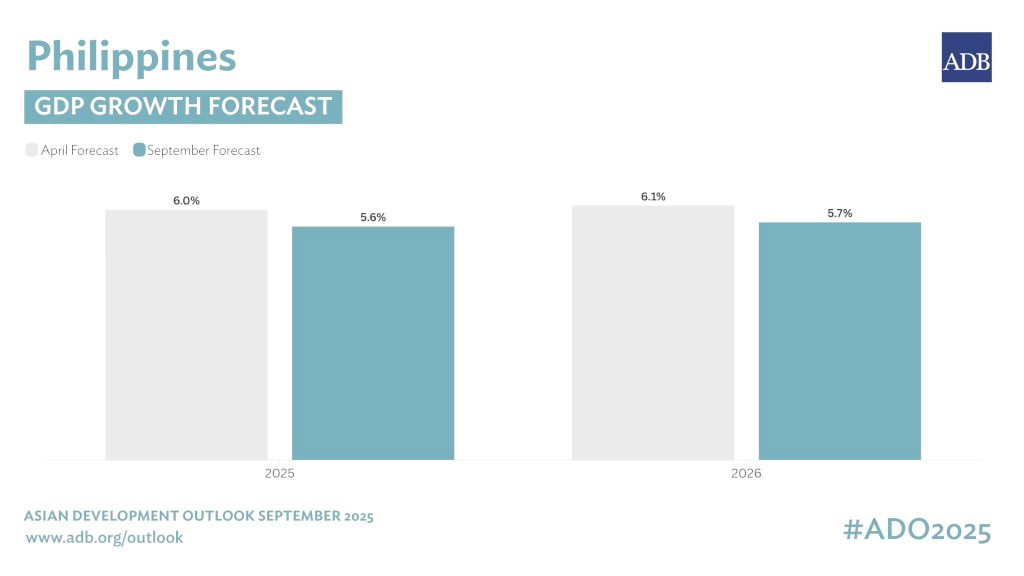

THE Asian Development Bank (ADB) has revised downward its 2026 Philippine economic growth outlook to 5.7 percent from an earlier projection of 5.8 percent.

ADB’s September update to its current Asian Development Outlook (ADO) report, however, sees the economy cruising along this year, keeping its 2025 growth outlook for the country steady at 5.6 percent.

Bright spot in SEAsia

The Manila-based institution maintained that the Philippines will remain a “bright spot in Southeast Asia, with the second highest GDP expansion in the region.”

“The Philippines’ growth outlook remains resilient amid a global environment of shifting trade and investment policies, and heightened geopolitical uncertainties. Though these uncertainties pose increased risk, we see strong domestic demand anchoring growth, with sustained investments and an accommodative monetary policy supporting the economy’s expansion,” ADB Country Director for the Philippines Andrew Jeffries said.

2025 inflation seen easing to 1.8%

The ADB also lowered its inflation forecast for 2025 at 1.8 percent from an earlier forecast of 2.2 percent, but it sees the rate rising to 3 percent in 2026.

The government’s full-year target range is 2 to 4 percent.

“Slower global commodity prices and muted food prices, in part due to the improved local supply of the country’s rice staple, will keep inflation low. This subdued inflation outlook will support an accommodative monetary policy, though adverse weather conditions and climate shocks could put pressure on commodity prices,” the ADB said in the report.

Downside risks to the growth outlook include external headwinds from heightened uncertainty, further shifts in global economic policies, and rising trade barriers, which could affect market sentiment and hinder economic growth, the ADB report added.

Sustained investment

Government investment, including in social services, is seen boosting domestic demand, with business sentiment remaining positive as shown by the Bangko Sentral ng Pilipinas’ (BSP) Q2 2025 survey, though softer amid external headwinds.

The ADB noted the government aims to maintain infrastructure spending at 5 to 6 percent of gross domestic product (GDP) over the medium term.

“The Accelerated and Reformed Right-of-Way Act signed into law this month streamlines the land acquisition process for government and public-private partnership projects, which will help speed up infrastructure investments,” the ADB report said.

“This new law will benefit the government’s flagship projects, including the ADB-financed Malolos-Clark Railway Project and the South Commuter Railway Project, which will link Metro Manila to northern and southern provinces in the Luzon region; and the Bataan-Caite Interlink Bridge Project, which is expected to be one of the world’s longest bridges when completed,” it said.

ADB’s consumer outlook for 2026, meanwhile, remains optimistic, partly supported by a steady inflow of remittances from overseas Filipinos, which, it said, bodes well for private consumption growth.

Outcry vs corruption

Country Director Jeffries said the bank is monitoring how the current outcry on corruption involving government infrastructure projects will affect investment sentiments and economic output moving forward.

“Because a large percentage, I think 60 percent, of GDP is underpinned by domestic consumption and other factors and low inflation and the like, we didn’t see a reason to reduce GDP projections due to that issue at this point. But it’s certainly a heightened risk. And between now and our December update, there may be more kind of quantifiable data available,” he said.

Jeffries said the agency takes the issue of corruption and public financial management very seriously and that the ADB “employs strict oversight and due diligence on the financial management capabilities of their borrowers.”

“So we take this very seriously and the government — we actually see potentially more support being asked of us to help address this problem going forward,” he said.

In particular, Jeffries said the ADB has a joint agreement with the World Bank Group to cross-debar contractors involved in questionable activities. He added that may also involve blacklisting contractors identified in the current anomaly in the country’s infrastructure projects, provided the government sanctions them first.