More Filipinos are going cashless and transacting in e-money or digital cash as the most preferred payment for retail accounts, the Bangko Sentral ng Pilipinas (BSP) said in a report on Monday.

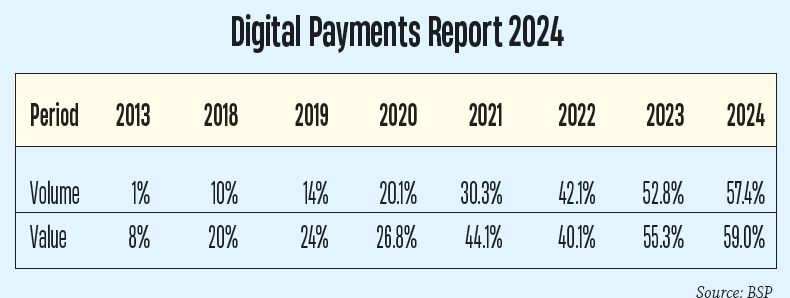

Based on the latest BSP status report, digital payments now account for 57.4 percent of retail transactions by volume as of end-2024, up from 52.8 percent in 2023. In terms of value, e-money’s share also increased to 59 percent from 55.3 percent.

The figures surpassed the government’s target range of between 52 and 54 percent as set under the Philippine Development Plan 2023–2028.

BSP Governor Eli M. Remolona Jr. said the steady year-on-year growth “reinforces the momentum built after surpassing the 2023 digitalization target of 50 percent for volume.”

He also said the upward trajectory “reflects the long-term impact of market developments, policy initiatives, and the growing trust and familiarity of Filipinos with digital payment options.”

Remolona said the BSP will continue to harness technology and finance to connect markets and ensure that “every Filipino becomes part of the formal financial system.”

They will do this by empowering banks, non-banks and the fintech sector to leverage innovation in designing financial products that are not only accessible but also more responsive to the needs of consumers.”

Improvement by volume

Consistent with the previous year, the latest BSP report showed that merchant payments, person-to-person (P2P) transfers, and business-to-business (B2B) supplier payments remained key contributors to growth in digital payments.

Merchant payments comprised 66.4 percent of the monthly digital payment volume, while P2P transfers and B2B supplier payments accounted for 20.6 percent and 6.2 percent, respectively.

The report said these three drove the surge in digital transactions, collectively accounting for 93.2 percent of the total volume.

The data also showed payments made by the government have consistently remained the most “cash-lite among the three primary payment use cases,” with 97.2 percent of transactions conducted digitally as of end-2024.

Meanwhile, payments made by persons had a remarkable leap toward digitalization, with 72.2 percent of total transactions processed through digital channels.

The BSP said this increase is accompanied by a drop in the volume of non-digital payments, which could indicate a shifting preference to pay digitally.

By value

As of end-2024, the total value of monthly digital payments has reached $136 billion or P7.616 trillion, accounting for 59 percent of the country’s overall retail transaction value.

Among the three payment use cases, the government sector remains at the forefront of digitalization with 97.2 percent. Payments made by persons digitally have increased by 5.3 percent or 80.4 percent of total transaction value.

Meanwhile, payments made by businesses digitally represent 38.6 percent of the overall total value.

The report said this development underscores a significant shift toward digital financial systems, reflecting increased public trust and reliance on digital payment infrastructure as the country advances toward a more digitally integrated economy.

More accessible

The BSP’s strategic approach remains focused on enhancing the payments ecosystem, particularly through interoperable systems, public-private partnerships, and the development of use cases that benefit all sectors of society.

“Expansion of the digital finance ecosystem makes transactions more accessible, affordable, and inclusive. It also helps microenterprises and underserved sectors thrive in the formal financial system,” the report said.

The report added that the BSP remains committed to promoting a safe, efficient, and inclusive payments system.

Improved access

Philippine Institute for Development Studies research fellow John Paolo Rivera said the steady rise in digital payments shows that cashless is becoming the new norm in the Philippines.

“This growth reflects improved access to digital platforms, stronger consumer trust, and continued support from the BSP’s Digital Payments Transformation Roadmap,” Rivera said in a Viber message.

He said that the continuous growth also signals deeper financial inclusion and greater efficiency in everyday transactions, from bills and remittances to market purchases and small business sales.

“As digital ecosystems expand into more rural and informal sectors, we can expect this upward trend to continue in 2025 and beyond,” Rivera said.

Ateneo economist Leonardo Lanzona said digital transactions lead to lower transaction costs and improved movements of money to spur growth.

However, Lanzona warned that if these are left unregulated and without consumer protection, “scamming activities can be rampant, causing a lot of people to move away from it.”

Chief economist Michael Ricafort of Rizal Commercial Banking Corp., meanwhile, said the continued increase in digital payments may be attributed to the higher use of e-wallets, especially by the masses, as expedited by the pandemic. It was more convenient and safer to use digital cash compared to physical banknotes and coins.

He added the increased usage stem from continued growth and adaptation of online business transactions, as well as increased use of delivery services, TNVS, and other online solutions that also make digital transactions more convenient.

“More Filipinos have adopted online banking transactions through banking apps instead of over-the-counter banking transactions, such as the use of InstaPay and PESONet as an alternative to bank checks for greater convenience, safety, reliability, and lower cost of transactions. These are also available anytime and from anywhere,” Ricafort said.

He also said that digital payment systems also increased financial inclusion in the country, especially in rural areas that have no or limited physical bank branches.

“For the coming years, use of digital payment systems could still increase further amid greater financial literacy, higher incomes, and as more Filipinos embrace more online business transactions and digital payment solutions,” Ricafort said.