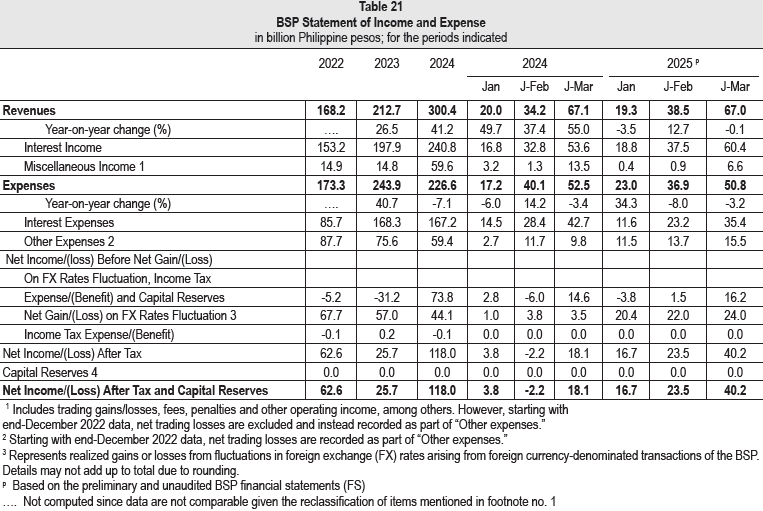

The Bangko Sentral ng Pilipinas (BSP) posted a first-quarter profit of P40.2 billion, more than double last year’s P18.1 billion, as foreign exchange gains and lower interest expenses offset weaker revenues.

Central bank data showed revenues for the three months to March down 0.15 percent at P67 billion, compared with a year earlier. Interest income climbed nearly 13 percent to P60.4 billion, but miscellaneous income fell by half to P6.6 billion.

Expenditures dropped 3.2 percent to P50.8 billion, led by a sharp 17 percent decline in interest expenses to P35.4 billion. That helped cushion higher trading losses, which rose 58 percent to P15.5 billion.

The real windfall came from foreign exchange operations: gains jumped almost sixfold to P24 billion from P3.5 billion. These reflect profits from currency swings on the BSP’s foreign-denominated transactions.

By end-March, the BSP’s assets reached P7.79 trillion, up 2.8 percent from a year earlier, while liabilities rose 1.4 percent to P7.52 trillion. Net worth surged 72 percent to P271.5 billion, bolstered by surplus reserves that more than doubled to P211.5 billion.

The central bank’s capital, however, remained stuck at P60 billion—well short of the P200 billion target set under its amended charter. The gap is expected to persist, as dividends are being redirected to seed the Maharlika Investment Fund, delaying the buildup of BSP’s own capital base.