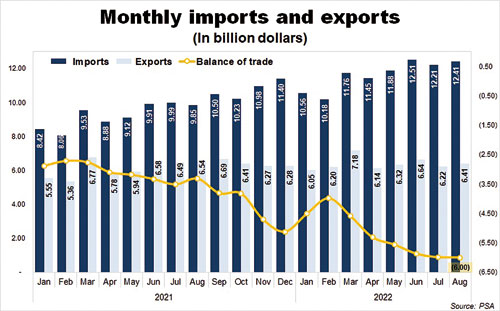

The country’s trade deficit hit its widest monthly gap on record at $6 billion in August, as value of imports jumped 26 percent from a year ago level while exports dropped by 2 percent, data from the Philippine Statistics Authority (PSA) showed.

The trade deficit posted an annual increase of 81.3 percent from the -$3.31 billion recorded a year ago.

Total imported goods in August 2022 amounted to $12.41 billion, almost $3 billion higher than the $9.85 billion posted a year ago.

The country’s total export sales in August 2022, meanwhile, amounted to $6.41 billion or $100 million lower than the $6.54 billion recorded in the same period a year ago.

PSA said the annual growth in the value of imported goods in August 2022 was mainly due to the increases in the values of all the top 10 major commodity groups, with transport equipment having the fastest annual growth rate of 75.8 percent.

This was followed by mineral fuels, lubricants and related materials, which rose by 75.6 percent annually; and other food and live animals by 43 percent.

Of the top 10 major commodity groups, four recorded annual decreases in terms of the value of exports. These were other mineral products (-23.8 percent), chemicals (-9.5 percent), machinery and transport equipment (-2.4 percent) and electronic products (-1.6 percent).

Michael Ricafort, Rizal Commercial Banking Corp. chief economist, said the trade deficit for the month may have been bloated by elevated prices of imported oil and other major global commodities largely brought about by the Russia-Ukraine war.

Local factor may be the further re-opening of the local economy towards greater normalcy that led to some pick up in imports.

“The record trade deficit may have fundamentally contributed to the weaker peso to new records recently; but it is considered a lagging economic indicator, since global crude oil prices already eased to the lowest in seven to eight months recently, or even lower since the start of the Russia-Ukraine conflict, thereby could help ease the country’s oil import bill as well as help ease inflationary pressures for the coming months,” Ricafort said.

“Alongside global crude oil prices, wheat and some global commodity prices also similarly eased in recent months partly due to risk of recession in the US, amid aggressive Fed rate hikes to bring down elevated US inflation, as well as the continued lockdowns in China,” Ricafdort said.

He said this could also “somewhat help ease the country’s import bill and trade deficit from record levels and also help ease headline inflation as well.”

Prices of key consumer items continued to rise in September, fastest in four years, and the country’s economic managers said it will remain elevated for the rest of this year.

Inflation accelerated to 6.9 percent, from 6.3 percent in August 2022, the highest recorded inflation since October 2018.

Average rate from January to September 2022 now stands at 5.1 percent, breaching the tip of the central bank’s full-year target range of between 2 and 4 percent by more than a percentage point.

Last year, inflation rate was at 4.2 percent.

PSA said the acceleration in the country’s inflation rate “was primarily due to the higher annual growth rate in the index for food and non-alcoholic beverages.”

This was followed by housing, water, electricity, gas, and other fuels.

Also contributing to the uptrend were the higher annual increases in the indices of alcoholic beverages and tobacco; clothing and footwear; furnishings, household equipment, and routine household maintenance; information and communication; recreation, sport, and culture; restaurants and accommodation services; and personal care, and miscellaneous goods and services.