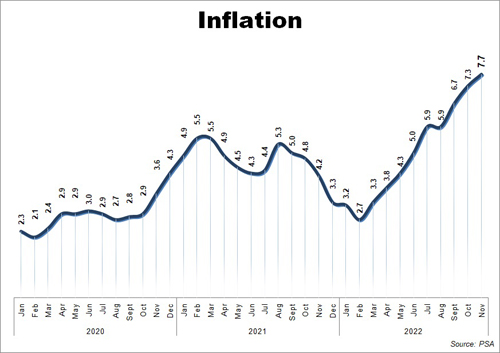

Prices of key consumer goods continued to surge in November, hitting a 14-year high, as food, non-alcoholic beverages, electricity and transport services remain costly nationwide.

Inflation accelerated to 8 percent in November from 7.7 percent the previous month, the fastest recorded inflation since November 2008.

The country’s average inflation rate stood at 5.6 percent, way over the government’s target range of between 2 and 4 percent.

Core inflation, which excludes selected food and energy items in the headline inflation, also increased to 6.5 percent from 5.9 percent in October.

President Marcos Jr. is confident the Philippines is on track to maintain its strong economic performance and is expected to reach its annual growth target of 6.5 percent to 7.5 percent even while the inflation is “running rampant and out of control.”

The President, in addressing the 11th Arangkada Philippines Forum 2022 held at Marriott Hotel, Pasay City, said the country continues on its road to recover from the negative impact of the coronavirus disease () pandemic which is proven by the “healthy” growth rate,” the stronger peso compared to other currencies, and the “quite reasonable” unemployment rate.

“The country is on track to maintain a strong economic performance and achieve the government’s growth target…However, on the other side of the coin, there is still inflation that is running rampant and out of control,” Marcos said.

He said as the main drivers of that inflation are imported, “import substitution is still a good idea not only for foreign exchange reserves but also to keep our inflation rate down.”

He also mentioned the need to strengthen and improve the manufacturing sector, particularly the domestic market and need for capital intensive investments.

The Philippine Statistics Authority (PSA) yesterday said the sustained acceleration of inflation “was mainly due to the higher year-on-year growth rate in the index of food and non-alcoholic beverages at 10 percent, from 9.4 percent in October.”

PSA also attributed the uptrend to the higher annual increment in the index of restaurants and accommodation services at 6.5 percent, from 5.7 percent the previous month.

Other price indexes that surged include alcoholic beverages and tobacco; clothing and footwear; furnishings, household equipment and routine household maintenance; health; information and communication; recreation, sport and culture; education services; and personal care, and miscellaneous goods and services.

Slower year-on-year increases were observed in the indices of housing, water, electricity, gas and other fuels and transport at 12.3 percent.

Risks remain tilted

Felipe Medalla, Bangko Sentral ng Pilipinas (BSP) governor, said inflation is “projected to decelerate in the subsequent months due to easing global oil and non-oil prices, negative base effects, and as the impact of BSP’s cumulative policy rate adjustments work its way to the economy.”

“The November outturn is within the BSP’s forecast range of 7.4 to 8.2 percent. The risks to the inflation outlook remain tilted to the upside for 2023 but are seen to be broadly balanced for 2024,” Medalla said.

He said the key upside risks are the potential impact on international food prices of higher fertilizer prices, trade restrictions and adverse global weather conditions.

“Higher food prices from further domestic weather-related disturbances and supply disruptions in key food commodities such as sugar and meat, as well as pending petitions for transport fare hikes were also identified as upside risks to the inflation outlook in the latest round. Meanwhile, the impact of a weaker-than-expected global economic recovery is the primary downside risk to the outlook,” Medalla said.

PSA data showed food inflation at the national level rose further to 10.3 percent from 9.8 percent in October.

The uptick in the food inflation was primarily influenced by the higher annual growths in the vegetables, tubers, plantains, cooking bananas and pulses index at 25.8 percent; and rice index at 3.1 percent.

Faster annual increments were also noted in flour, bread and other bakery products, pasta products, and other cereals; milk, other dairy products and eggs; fruits and nuts; sugar, confectionery and desserts; and ready-made food and other food products.

Likely the peak

Michael Ricafort, RCBC chief economist, said there is a chance year-on-year inflation “could have already reached the peak in the fourth quarter and could start to ease gradually.”

“(Inflation) could even ease year-on-year significantly, especially starting first quarter (of next year) due to higher base/denominator effects, as the peak in global crude oil prices in early March 2022 already significantly corrected lower. Furthermore, year-on-year inflation would mathematically ease further in the second half of 2023 due to much higher base/denominator effects, in view of the anniversary of wage hikes and transport fare hikes starting June-July 2022 that led to second-round inflation effects,” Ricafort said.

He said the November surge was partly due to Tropical Storm Paeng’s damage on hard-hit agricultural areas, continued second-round inflation effects as well as some increase in demand in preparation for the holiday season — all of which led to higher food prices and overall inflation.

Important leading indicators for global and local inflation, Ricafort said, include other major global commodity prices such as wheat, soybean, natural gas, coal, iron, steel, copper and nickel which eased in recent weeks “could help ease inflationary pressures for the coming months.”

More policy actions

Medalla said the Monetary Board, which he also chairs, will continue to assess the country’s inflation outlook and macroeconomic prospects in its monetary policy meeting on December 15.

“The BSP remains prepared to take all further monetary policy actions necessary to bring inflation back to a target-consistent path over the medium-term. The BSP is also reassured by the timely implementation of non-monetary government measures to mitigate the impact of persistent supply-side pressures on inflation,” Medalla said.

As prices continue to rise, the Monetary Board last month hiked the key rates of the BSP by 75 basis points, bringing it to its highest in almost 14 years.

The interest rate on the BSP’s overnight reverse repurchase facility now stands at 5.0 percent. The interest rates on the overnight deposit and lending facilities now stand at 4.5 percent and 5.5 percent, respectively.

Medalla said the latest baseline forecasts indicate a higher inflation path over the policy horizon, with average inflation breaching the upper end of the 2-4 percent target range in both 2022 and 2023 and possibly hitting 5.8 percent and 4.3 percent, respectively. The forecast for 2024 has also risen slightly to 3.1 percent.

Ricafort said, “Further local policy rate hikes could still be possible for the coming months as supported by generally strong economic data.”

He added that the Monetary Board will likely, again, mirror the move of the Federal Reserve which is expected to raise US key rates by another 50 basis points on December 14.

“There was never an instance wherein the local policy rate is lower than the Fed Funds Rate (now at 4.00 percent) at least over the past 20 years or even before that, in view of the difference in the credit ratings of the US and the Philippines, as well as the difference in the long-term inflation outlook of the two countries,” Ricafort said.

He said higher local policy rates would lead to some increase in borrowing costs that could lead to lower earnings and valuations, as well as slow down the economy as an unintended consequence in the quest to fight off inflationary pressures.